Asked by ka ki cheng on Jul 04, 2024

Verified

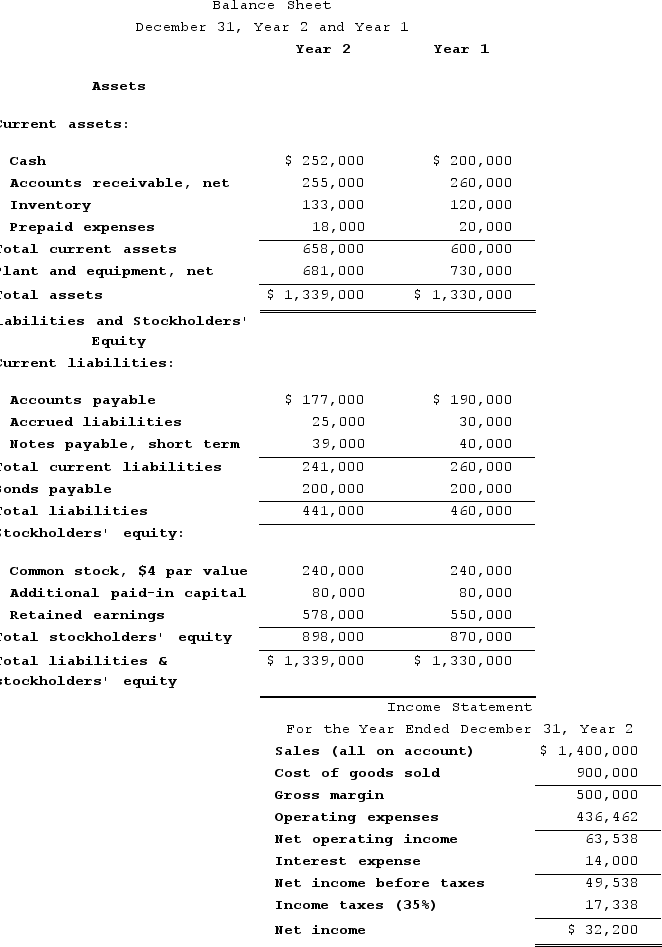

Moselle Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $4,200. The market price of common stock at the end of Year 2 was $9.72 per share.Required:a. What is the company's earnings per share for Year 2?b. What is the company's price-earnings ratio for Year 2?c. What is the company's dividend payout ratio for Year 2?d. What is the company's dividend yield ratio for Year 2?e. What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $4,200. The market price of common stock at the end of Year 2 was $9.72 per share.Required:a. What is the company's earnings per share for Year 2?b. What is the company's price-earnings ratio for Year 2?c. What is the company's dividend payout ratio for Year 2?d. What is the company's dividend yield ratio for Year 2?e. What is the company's book value per share at the end of Year 2?

Earnings Per Share

A measure of a company's profitability calculated by dividing its net earnings by the number of outstanding shares.

Price-Earnings Ratio

A valuation ratio for a company calculated by dividing its current share price by its earnings per share, indicating the dollar amount an investor can expect to invest in a company in order to receive one dollar of that company's earnings.

Dividend Payout Ratio

A financial ratio that shows the proportion of earnings a company pays out to shareholders in the form of dividends.

- Master the calculation of earnings per share and its pertinent market value ratios.

- Scrutinize and interpret a business's dividend practices by assessing payout and yield ratios.

- Calculate the book value per share for a company and understand its significance.

Verified Answer

Learning Objectives

- Master the calculation of earnings per share and its pertinent market value ratios.

- Scrutinize and interpret a business's dividend practices by assessing payout and yield ratios.

- Calculate the book value per share for a company and understand its significance.

Related questions

Jaquez Corporation Has Provided the Following Financial Data ...

Brill Corporation Has Provided the Following Financial Data ...

The Company's Book Value Per Share at the End of ...

_______ Is the Amount of Money Per Common Share That ...

_________ Is Equal to Common Shareholders' Equity Divided by Common ...