Asked by Allissa Jenkins on Jun 12, 2024

Verified

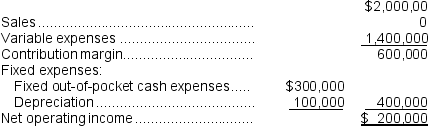

(Ignore income taxes in this problem.)Ursus, Inc., is considering a project that would have a ten-year life and would require a $1,000,000 investment in equipment.At the end of ten years, the project would terminate and the equipment would have no salvage value.The project would provide net operating income each year as follows:  All of the above items, except for depreciation, represent cash flows.The company's required rate of return is 12%.

All of the above items, except for depreciation, represent cash flows.The company's required rate of return is 12%.

Required:

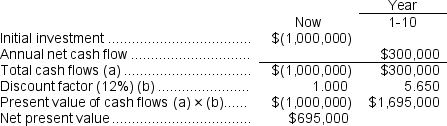

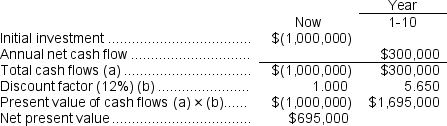

a.Compute the project's net present value.

b.Compute the project's internal rate of return to the nearest whole percent.

c.Compute the project's payback period.

d.Compute the project's simple rate of return.

Net Operating Income

A financial metric that calculates a company's profit after operating expenses are subtracted from operating revenues.

Required Rate

This is the minimum expected rate of return on an investment, dictating the least acceptable compensation for investing capital.

Salvage Value

A prediction of what an asset will be worth on the market at the close of its effective life.

- Gain insight into the considerations necessary for investment decision processes, omitting income tax considerations.

- Learn to evaluate the long-term financial implications of investments, including their termination and salvage values.

Verified Answer

LA

Leena AlayedhJun 19, 2024

Final Answer :

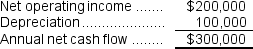

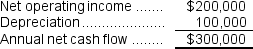

a.Because depreciation is the only noncash item on the income statement, the annual net cash flow can be computed by adding back depreciation to net operating income.

b.The formula for computing the factor of the internal rate of return (IRR)is:

b.The formula for computing the factor of the internal rate of return (IRR)is:

Factor of the IRR = Investment required ÷ Annual net cash inflow

= $1,000,000 ÷ $300,000 = 3.333

This factor is closest to the present value of an annuity over 10 years at 27%.Therefore, to the nearest whole percent, the internal rate of return is 27%.

c.The formula for the payback period is:

Investment required ÷ Annual net cash inflow = Payback period

$1,000,000 ÷ $300,000 per year = 3.33 years

d.The formula for the simple rate of return is:

Simple rate of return = Net operating income ÷ Initial investment

= $200,000 ÷ $1,000,000 = 20.0%

b.The formula for computing the factor of the internal rate of return (IRR)is:

b.The formula for computing the factor of the internal rate of return (IRR)is:Factor of the IRR = Investment required ÷ Annual net cash inflow

= $1,000,000 ÷ $300,000 = 3.333

This factor is closest to the present value of an annuity over 10 years at 27%.Therefore, to the nearest whole percent, the internal rate of return is 27%.

c.The formula for the payback period is:

Investment required ÷ Annual net cash inflow = Payback period

$1,000,000 ÷ $300,000 per year = 3.33 years

d.The formula for the simple rate of return is:

Simple rate of return = Net operating income ÷ Initial investment

= $200,000 ÷ $1,000,000 = 20.0%

Learning Objectives

- Gain insight into the considerations necessary for investment decision processes, omitting income tax considerations.

- Learn to evaluate the long-term financial implications of investments, including their termination and salvage values.