Asked by Lilinoe Kekaula-VanGieson on Jul 11, 2024

Verified

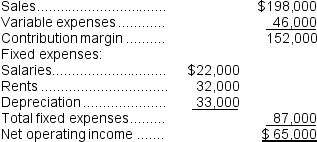

(Ignore income taxes in this problem.)Ostermeyer Corporation is considering a project that would require an initial investment of $247,000 and would last for 7 years.The incremental annual revenues and expenses for each of the 7 years would be as follows:  At the end of the project, the scrap value of the project's assets would be $16,000.

At the end of the project, the scrap value of the project's assets would be $16,000.

Required:

Determine the payback period of the project.Show your work!

Incremental Annual Revenues

The additional revenue generated from a specific action or decision, measured on an annual basis.

Scrap Value

The estimated resale value of an asset at the end of its useful life, typically associated with machinery, equipment, or vehicles.

Payback Period

The length of time required to recover the cost of an investment or project from its cash flows.

- Comprehend the importance of cash inflows and outflows in making financial decisions.

- Familiarize with the aspects crucial in decision-making for investments without factoring in income taxes.

Verified Answer

IJ

ibette jimenezJul 18, 2024

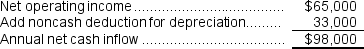

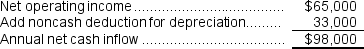

Final Answer :  Payback period = Investment required ÷ Annual net cash inflow

Payback period = Investment required ÷ Annual net cash inflow

= $247,000 ÷ $98,000 = 2.52 years

Payback period = Investment required ÷ Annual net cash inflow

Payback period = Investment required ÷ Annual net cash inflow= $247,000 ÷ $98,000 = 2.52 years

Learning Objectives

- Comprehend the importance of cash inflows and outflows in making financial decisions.

- Familiarize with the aspects crucial in decision-making for investments without factoring in income taxes.