Asked by elizabeth mccloskey on May 25, 2024

Verified

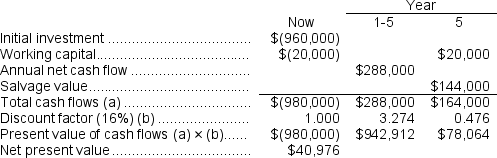

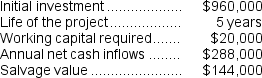

(Ignore income taxes in this problem.)Tiff Corporation has provided the following data concerning a proposed investment project:  The company uses a discount rate of 16%.The working capital would be released at the end of the project.

The company uses a discount rate of 16%.The working capital would be released at the end of the project.

Required:

Compute the net present value of the project.

Discount Rate

The interest rate used in discounted cash flow (DCF) analysis to present value future cash flows, or in other cases, the central bank's interest rate for banks.

Net Present Value

The contrast between the present-valued cash inflows and outflows over a determined period.

Working Capital

The gap between a business's current assets versus its current liabilities, reflecting its short-term solvency and efficiency in operations.

- Comprehend and utilize the principle of Net Present Value (NPV) within the context of making investment choices.

- Comprehend the principle of managing working capital within project assessment.

Verified Answer

SM

Learning Objectives

- Comprehend and utilize the principle of Net Present Value (NPV) within the context of making investment choices.

- Comprehend the principle of managing working capital within project assessment.