Asked by Meagan Silver on May 05, 2024

Verified

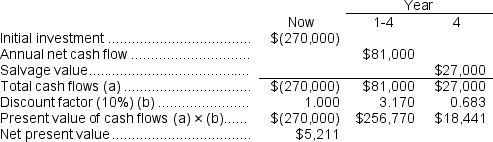

(Ignore income taxes in this problem.)Strausberg Inc.is considering investing in a project that would require an initial investment of $270,000.The life of the project would be 4 years.The annual net cash inflows from the project would be $81,000.The salvage value of the assets at the end of the project would be $27,000.The company uses a discount rate of 10%.

Required:

Compute the net present value of the project.

Salvage Value

The anticipated end-of-service-life residual value of an asset.

Discount Rate

The interest rate used in discounted cash flow analysis to determine the present value of future cash flows, reflecting the investment's risk and the time value of money.

Net Present Value

A financial metric that calculates the difference between the present value of cash inflows and outflows over a period of time, used for assessing the profitability of investments.

- Understand and apply the concept of Net Present Value (NPV) in capital budgeting decisions.

Verified Answer

EA

Learning Objectives

- Understand and apply the concept of Net Present Value (NPV) in capital budgeting decisions.