Asked by Kaylee Greydanus on Apr 30, 2024

Verified

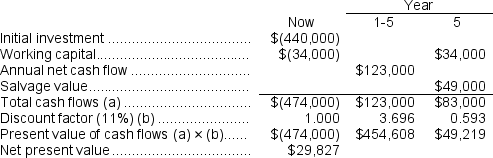

(Ignore income taxes in this problem.)Mattice Corporation is considering investing $440,000 in a project.The life of the project would be 5 years.The project would require additional working capital of $34,000, which would be released for use elsewhere at the end of the project.The annual net cash inflows would be $123,000.The salvage value of the assets used in the project would be $49,000.The company uses a discount rate of 11%.

Required:

Compute the net present value of the project.

Discount Rate

In discounted cash flow analysis, this is the interest rate utilized to calculate the present value of cash flows expected in the future.

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment by calculating the difference between the present value of cash inflows and outflows over a period of time.

Working Capital

The difference between a company's current assets and its current liabilities, indicating the liquidity and operational efficiency of the business.

- Gain understanding of and execute the Net Present Value (NPV) approach in financial decision-making for capital investments.

- Understand the concept of working capital management in project evaluation.

Verified Answer

OO

Learning Objectives

- Gain understanding of and execute the Net Present Value (NPV) approach in financial decision-making for capital investments.

- Understand the concept of working capital management in project evaluation.