Asked by Kennedy Willens on Apr 30, 2024

Verified

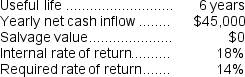

(Ignore income taxes in this problem.) Welch Corporation is planning an investment with the following characteristics:  The initial cost of the equipment is closest to:

The initial cost of the equipment is closest to:

A) $157,410

B) $175,005

C) $235,890

D) Cannot be determined from the given information.

Initial Cost

The upfront expenditure involved in the purchase of an asset or the start of a project.

Capital Budgeting

The process by which a business evaluates and plans for significant investments in projects or assets.

- Become familiar with the notion and numerical estimation of Net Present Value (NPV), along with its relevance in making decisions regarding capital budgeting.

- Acknowledge the impact of cash inflows and cash outflows on determining the sustainability of a project.

Verified Answer

ZK

Zybrea KnightMay 02, 2024

Final Answer :

A

Explanation :

The internal rate of return is the rate of return at which the net present value of the project is zero.

Net present value = -Investment required + (Net annual cash inflow × Present value factor of an annuity for 6 years at 18%)

$0 = -Investment required + ($45,000 × 3.498)

Investment required = $45,000 × 3.498 = $157,410

Net present value = -Investment required + (Net annual cash inflow × Present value factor of an annuity for 6 years at 18%)

$0 = -Investment required + ($45,000 × 3.498)

Investment required = $45,000 × 3.498 = $157,410

Learning Objectives

- Become familiar with the notion and numerical estimation of Net Present Value (NPV), along with its relevance in making decisions regarding capital budgeting.

- Acknowledge the impact of cash inflows and cash outflows on determining the sustainability of a project.