Asked by Aerial Johnson on Jul 04, 2024

Verified

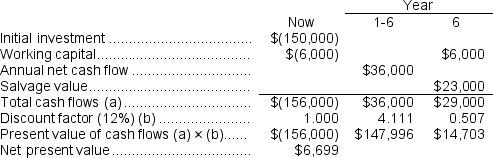

(Ignore income taxes in this problem.) Dowlen, Inc., is considering the purchase of a machine that would cost $150,000 and would last for 6 years.At the end of 6 years, the machine would have a salvage value of $23,000.The machine would reduce labor and other costs by $36,000 per year.Additional working capital of $6,000 would be needed immediately.All of this working capital would be recovered at the end of the life of the machine.The company requires a minimum pretax return of 12% on all investment projects.The net present value of the proposed project is closest to:

A) $9,657

B) $(2,004)

C) $6,699

D) $13,223

Salvage Value

This is the estimated resale value of an asset at the end of its useful life.

Net Present Value

Net Present Value is a financial metric that calculates the difference between the present value of cash inflows and outflows over a period of time, used to assess the profitability of an investment.

Pretax Return

The income an investment generates before taxes are taken into account.

- Ascertain the suitability of the net present value method in different contexts.

- Determine the net present value of an investment initiative by accounting for all significant cash flows.

- Analyze the role of working capital in determining the profitability and the investment needed for a project.

Verified Answer

Learning Objectives

- Ascertain the suitability of the net present value method in different contexts.

- Determine the net present value of an investment initiative by accounting for all significant cash flows.

- Analyze the role of working capital in determining the profitability and the investment needed for a project.

Related questions

In Calculating the Investment Required for the Project Profitability Index ...

Przewozman Corporation Has Provided the Following Information Concerning a Capital ...

Sester Corporation Has Provided the Following Information Concerning a Capital ...

Debona Corporation Is Considering a Capital Budgeting Project That Would ...

Dunstan Corporation Is Considering a Capital Budgeting Project That Involves ...