Asked by Chevelle Rhule on May 23, 2024

Verified

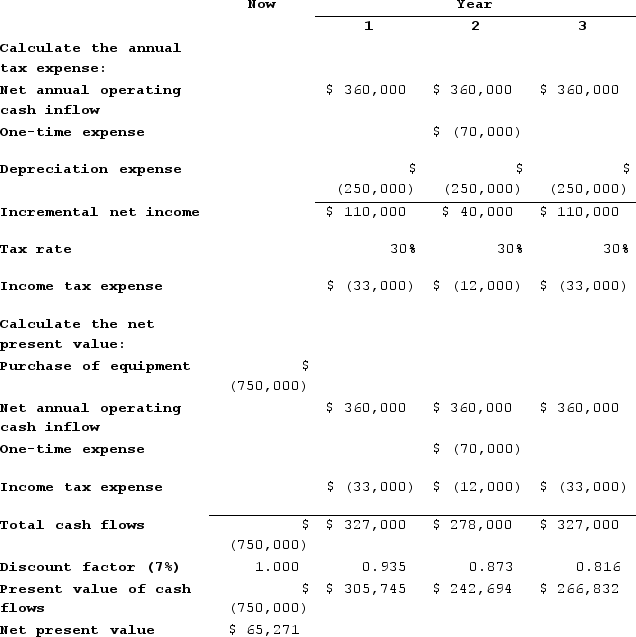

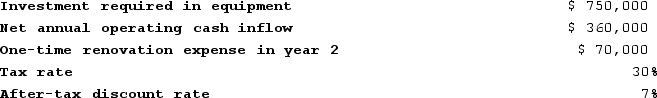

Sester Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Straight-Line Depreciation

A technique for determining an asset's depreciation by uniformly distributing its cost throughout its lifespan.

Operating Cash Inflow

Cash received by a company during its normal business operations.

After-Tax Discount Rate

The rate used to discount future cash flows to their present value, taking into account the effects of taxes.

- Evaluate the net present value of a project within capital budgeting, incorporating the costs of initial investments, subsequent cash flows, and salvage values.

- Assess the effect that depreciation methods, such as straight-line depreciation, have on the calculation of Net Present Value (NPV).

- Acquire knowledge of the foundational aspects of capital budgeting processes, with an emphasis on the Net Present Value (NPV) technique.

Verified Answer

Learning Objectives

- Evaluate the net present value of a project within capital budgeting, incorporating the costs of initial investments, subsequent cash flows, and salvage values.

- Assess the effect that depreciation methods, such as straight-line depreciation, have on the calculation of Net Present Value (NPV).

- Acquire knowledge of the foundational aspects of capital budgeting processes, with an emphasis on the Net Present Value (NPV) technique.

Related questions

Dunstan Corporation Is Considering a Capital Budgeting Project That Involves ...

Przewozman Corporation Has Provided the Following Information Concerning a Capital ...

Debona Corporation Is Considering a Capital Budgeting Project That Would ...

Skowyra Corporation Has Provided the Following Information Concerning a Capital ...

Roemen Corporation Is Considering a Capital Budgeting Project That Would ...