Asked by Emily Yannatone on Jun 15, 2024

Verified

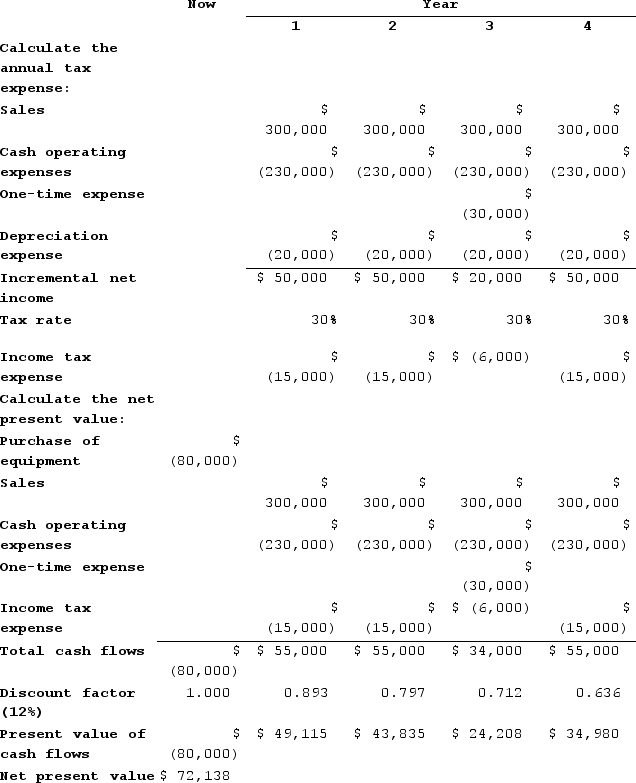

Debona Corporation is considering a capital budgeting project that would require investing $80,000 in equipment with a 4 year useful life and zero salvage value. Annual incremental sales would be $300,000 and annual incremental cash operating expenses would be $230,000. A one-time expense of $30,000 for renovations would be required in year 3. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 12%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Incremental Sales

The additional sales generated by a particular business activity or decision, beyond what would have been achieved without it.

One-Time Expense

An uncommon or unique expenditure that is not expected to recur in the foreseeable future, often highlighted separately in financial statements.

- Quantify the net present worth of a capital budgeting project, addressing the initial investments, cash inflow trajectories, and salvage assessments.

- Consider the effect of implementing depreciation, with an emphasis on the straight-line method, on the calculation of Net Present Value (NPV).

- Understand thoroughly the rudimentary aspects of capital budgeting strategies, focusing on the Net Present Value (NPV) method.

Verified Answer

Learning Objectives

- Quantify the net present worth of a capital budgeting project, addressing the initial investments, cash inflow trajectories, and salvage assessments.

- Consider the effect of implementing depreciation, with an emphasis on the straight-line method, on the calculation of Net Present Value (NPV).

- Understand thoroughly the rudimentary aspects of capital budgeting strategies, focusing on the Net Present Value (NPV) method.

Related questions

Sester Corporation Has Provided the Following Information Concerning a Capital ...

Dunstan Corporation Is Considering a Capital Budgeting Project That Involves ...

Przewozman Corporation Has Provided the Following Information Concerning a Capital ...

Skowyra Corporation Has Provided the Following Information Concerning a Capital ...

Roemen Corporation Is Considering a Capital Budgeting Project That Would ...