Asked by Dellvon Koolkid on Jul 01, 2024

Verified

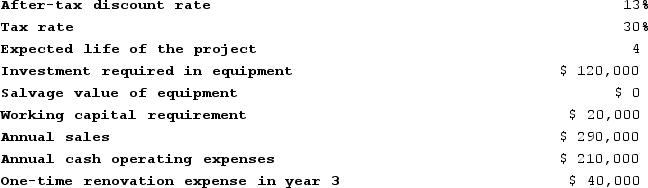

Przewozman Corporation has provided the following information concerning a capital budgeting project:

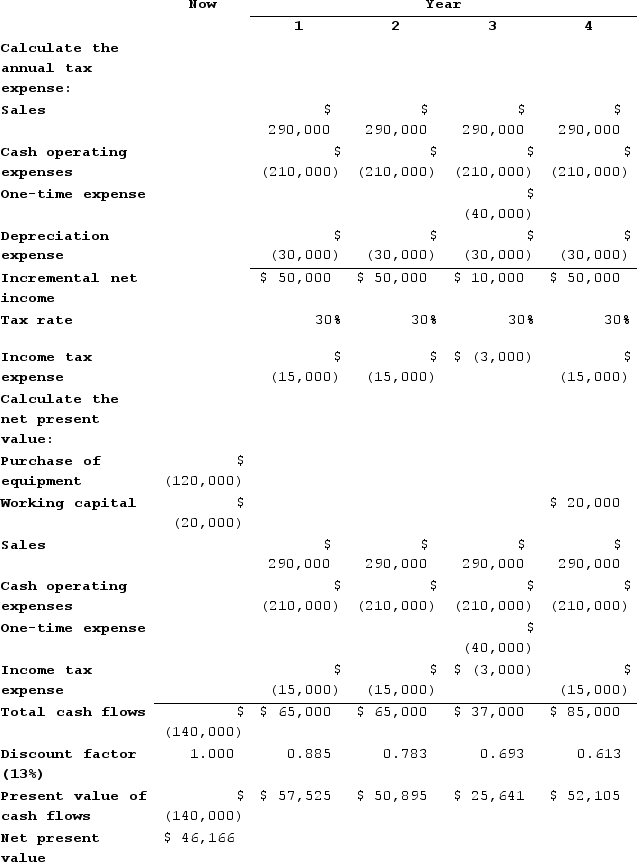

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Straight-Line Depreciation

A technique for breaking down the financial responsibility of a physical asset over its effective life in consistent yearly portions.

Working Capital

The variance between a firm's existing assets and liabilities, showcasing the immediate financial wellbeing and efficiency in operations of the company.

Capital Budgeting

The strategy of investigating and selecting long-term investments that correspond with the pursuit of amplifying shareholder wealth.

- Learn the core concepts of capital budgeting methodologies, including a focus on the Net Present Value (NPV) approach.

- Ascertain the net present value of a capital budgeting project, factoring in the initial investment, cash flows over time, and salvage values.

- Investigate the role of depreciation, including the straight-line technique, in influencing Net Present Value (NPV) estimates.

Verified Answer

Learning Objectives

- Learn the core concepts of capital budgeting methodologies, including a focus on the Net Present Value (NPV) approach.

- Ascertain the net present value of a capital budgeting project, factoring in the initial investment, cash flows over time, and salvage values.

- Investigate the role of depreciation, including the straight-line technique, in influencing Net Present Value (NPV) estimates.

Related questions

Dunstan Corporation Is Considering a Capital Budgeting Project That Involves ...

Skowyra Corporation Has Provided the Following Information Concerning a Capital ...

Sester Corporation Has Provided the Following Information Concerning a Capital ...

Debona Corporation Is Considering a Capital Budgeting Project That Would ...

Roemen Corporation Is Considering a Capital Budgeting Project That Would ...