Asked by Jennifer Gonzalez on May 11, 2024

Verified

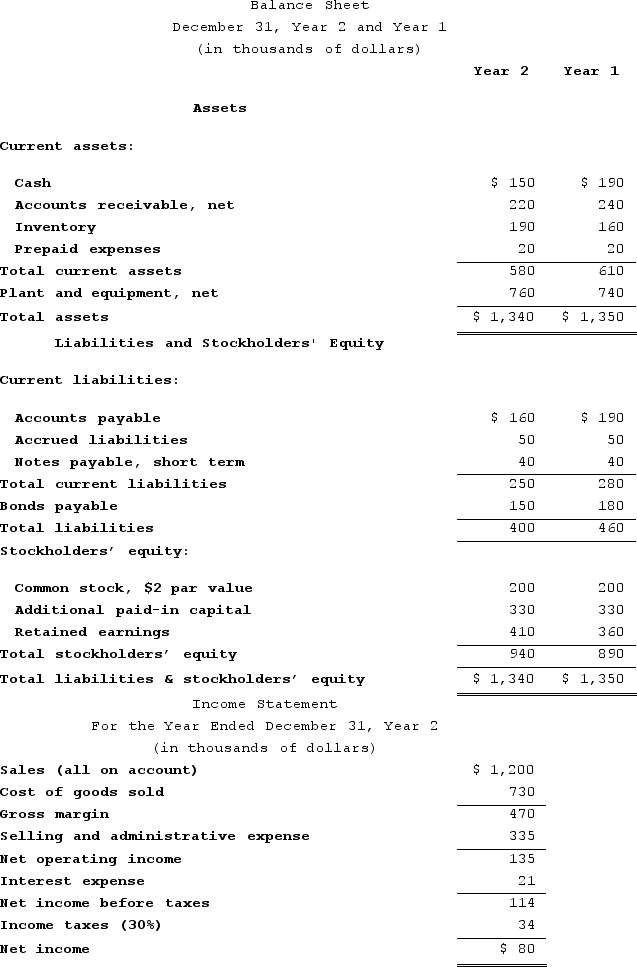

Hyrkas Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $30 thousand. The market price of common stock at the end of Year 2 was $6.90 per share.Required:Compute the following for Year 2:a. Gross margin percentage.b. Earnings per share.c. Price-earnings ratio.d. Dividend payout ratio.e. Dividend yield ratio.f. Return on total assets.g. Return on equity.h. Book value per share.i. Working capital.j. Current ratio.k. Acid-test (quick) ratio.l. Accounts receivable turnover.m. Average collection period.n. Inventory turnover.o. Average sale period.p. Times interest earned ratio.q. Debt-to-equity ratio.

Dividends on common stock during Year 2 totaled $30 thousand. The market price of common stock at the end of Year 2 was $6.90 per share.Required:Compute the following for Year 2:a. Gross margin percentage.b. Earnings per share.c. Price-earnings ratio.d. Dividend payout ratio.e. Dividend yield ratio.f. Return on total assets.g. Return on equity.h. Book value per share.i. Working capital.j. Current ratio.k. Acid-test (quick) ratio.l. Accounts receivable turnover.m. Average collection period.n. Inventory turnover.o. Average sale period.p. Times interest earned ratio.q. Debt-to-equity ratio.

Gross Margin Percentage

A financial metric that indicates the proportion of money left over from revenues after deducting the cost of goods sold, expressed as a percentage of total revenue.

Earnings Per Share

A measurement of a company's profitability, calculated by dividing net income by the number of outstanding shares of its common stock.

Price-Earnings Ratio

A valuation metric for stocks, calculated by dividing the current market price of a share by its earnings per share (EPS).

- Acquisition of knowledge regarding primary financial ratios and how to calculate them.

- Ability to analyze a company's financial performance based on provided data.

- Mastery in determining market-related ratios of a company, such as price-earnings ratio and dividend yield.

Verified Answer

Learning Objectives

- Acquisition of knowledge regarding primary financial ratios and how to calculate them.

- Ability to analyze a company's financial performance based on provided data.

- Mastery in determining market-related ratios of a company, such as price-earnings ratio and dividend yield.

Related questions

Steinkraus Corporation Has Provided the Following Data ...

Symons Corporation Has Provided the Following Financial Data: Dividends ...

Abdool Corporation Has Provided the Following Financial Data ...

Wegener Corporation's Most Recent Balance Sheet and Income Statement Appear ...

Profitability Ratios Measure ...