Asked by Carley Hirsch on Jun 11, 2024

Verified

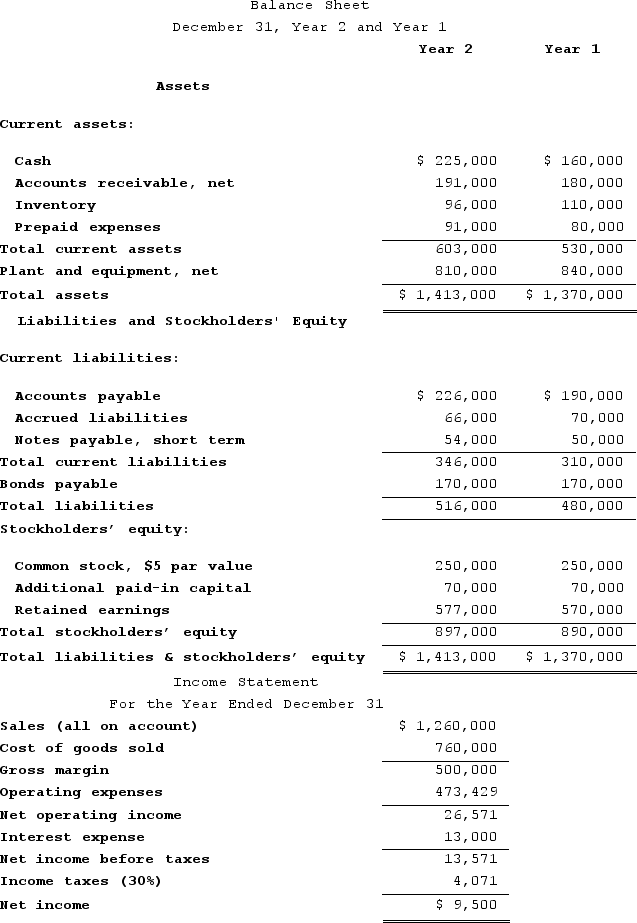

Symons Corporation has provided the following financial data:  Dividends on common stock during Year 2 totaled $2,500. The market price of common stock at the end of Year 2 was $2.01 per share.The company's earnings per share for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $2,500. The market price of common stock at the end of Year 2 was $2.01 per share.The company's earnings per share for Year 2 is closest to:

A) $0.53 per share

B) $11.54 per share

C) $0.19 per share

D) $0.27 per share

Earnings Per Share

A financial metric that calculates the portion of a company’s profit allocated to each outstanding share of common stock, indicating a company's profitability.

Common Stock

Equity ownership in a corporation, providing voting rights and potential dividends to shareholders.

Dividends

Disbursements issued by a company to its shareholders, often as an allocation of earnings.

- Mastery of crucial financial ratios along with their computation techniques.

Verified Answer

SS

Shamli SheemarJun 13, 2024

Final Answer :

C

Explanation :

To find the earnings per share, we need to use the formula: Earnings per share = (Net income – Preferred dividends) ÷ Weighted average common shares outstanding.

There is no information given about preferred dividends, so we can assume there are none.

We also do not have the net income of the company, but we can use the dividend information to find the total dividends paid for the year. Dividends per share = Dividends paid ÷ Weighted average common shares outstanding.

We can rearrange this formula to solve for weighted average common shares outstanding: Weighted average common shares outstanding = Dividends paid ÷ Dividends per share.

Substituting the values given: Weighted average common shares outstanding = $2,500 ÷ ($2.01 per share) = 1,243 shares.

Now, we can estimate the earnings per share using the market price of the stock. The price-earnings ratio (P/E ratio) is the market price per share divided by the earnings per share. Rearranging this formula, we get: Earnings per share = Market price per share ÷ P/E ratio.

We do not have the P/E ratio, but we can estimate it using the industry average P/E ratio or the company's historical P/E ratio. Let's assume the P/E ratio is 10 (which means investors are willing to pay $10 for every $1 of earnings).

Earnings per share = $2.01 per share ÷ 10 = $0.201 per share.

Rounding to the nearest cent, the earnings per share for Year 2 is $0.20 per share or closest to option C, $0.19 per share.

There is no information given about preferred dividends, so we can assume there are none.

We also do not have the net income of the company, but we can use the dividend information to find the total dividends paid for the year. Dividends per share = Dividends paid ÷ Weighted average common shares outstanding.

We can rearrange this formula to solve for weighted average common shares outstanding: Weighted average common shares outstanding = Dividends paid ÷ Dividends per share.

Substituting the values given: Weighted average common shares outstanding = $2,500 ÷ ($2.01 per share) = 1,243 shares.

Now, we can estimate the earnings per share using the market price of the stock. The price-earnings ratio (P/E ratio) is the market price per share divided by the earnings per share. Rearranging this formula, we get: Earnings per share = Market price per share ÷ P/E ratio.

We do not have the P/E ratio, but we can estimate it using the industry average P/E ratio or the company's historical P/E ratio. Let's assume the P/E ratio is 10 (which means investors are willing to pay $10 for every $1 of earnings).

Earnings per share = $2.01 per share ÷ 10 = $0.201 per share.

Rounding to the nearest cent, the earnings per share for Year 2 is $0.20 per share or closest to option C, $0.19 per share.

Learning Objectives

- Mastery of crucial financial ratios along with their computation techniques.