Asked by Jaylee Field on May 31, 2024

Verified

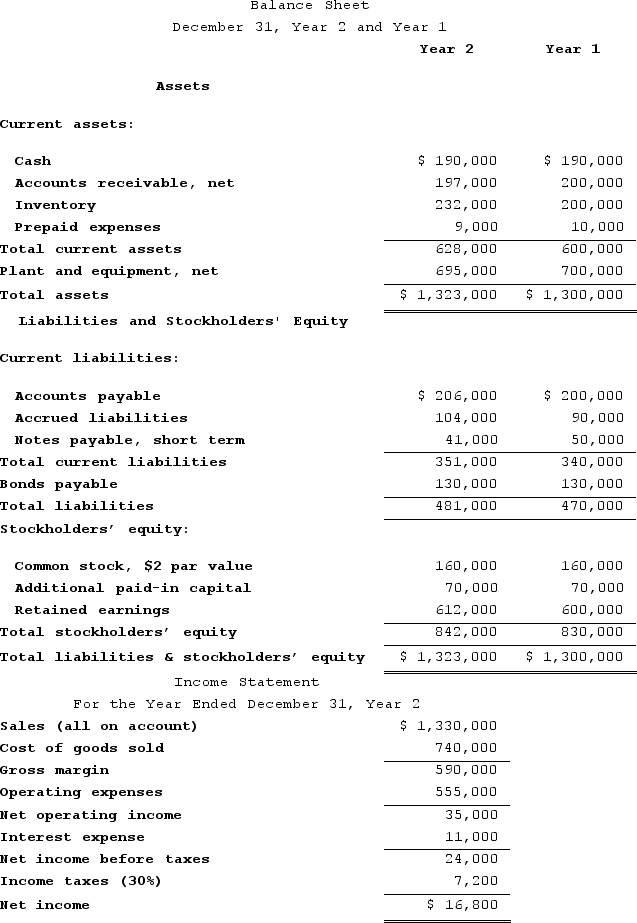

Abdool Corporation has provided the following financial data:

Required:a. What is the company's working capital at the end of Year 2?b. What is the company's current ratio at the end of Year 2?c. What is the company's acid-test (quick) ratio at the end of Year 2?d. What is the company's accounts receivable turnover for Year 2?e. What is the company's average collection period for Year 2?f. What is the company's inventory turnover for Year 2?g. What is the company's average sale period for Year 2?h. What is the company's operating cycle for Year 2?i. What is the company's total asset turnover for Year 2?

Required:a. What is the company's working capital at the end of Year 2?b. What is the company's current ratio at the end of Year 2?c. What is the company's acid-test (quick) ratio at the end of Year 2?d. What is the company's accounts receivable turnover for Year 2?e. What is the company's average collection period for Year 2?f. What is the company's inventory turnover for Year 2?g. What is the company's average sale period for Year 2?h. What is the company's operating cycle for Year 2?i. What is the company's total asset turnover for Year 2?

Working Capital

The variance between a business's immediate assets and its short-term obligations, signalling its ability to meet short-term debts.

Current Ratio

A financial liquidity ratio that compares a company's current assets to its current liabilities.

Accounts Receivable Turnover

A financial ratio that measures how efficiently a company collects on its credit sales by comparing net credit sales with the average accounts receivable over a period.

- Ability to interpret a firm's liquid financial resources through working capital, current ratio, and acid-test ratio.

- Expertise in dissecting a company's operating efficiency by analyzing turnover ratios.

Verified Answer

Learning Objectives

- Ability to interpret a firm's liquid financial resources through working capital, current ratio, and acid-test ratio.

- Expertise in dissecting a company's operating efficiency by analyzing turnover ratios.

Related questions

Arkin Corporation's Total Current Assets Are $290,000, Its Noncurrent Assets ...

Steinkraus Corporation Has Provided the Following Data ...

Wegener Corporation's Most Recent Balance Sheet and Income Statement Appear ...

Hyrkas Corporation's Most Recent Balance Sheet and Income Statement Appear ...

Gremel Corporation Has Provided the Following Financial Data ...