Asked by Jessica Hegyi on Jun 29, 2024

Verified

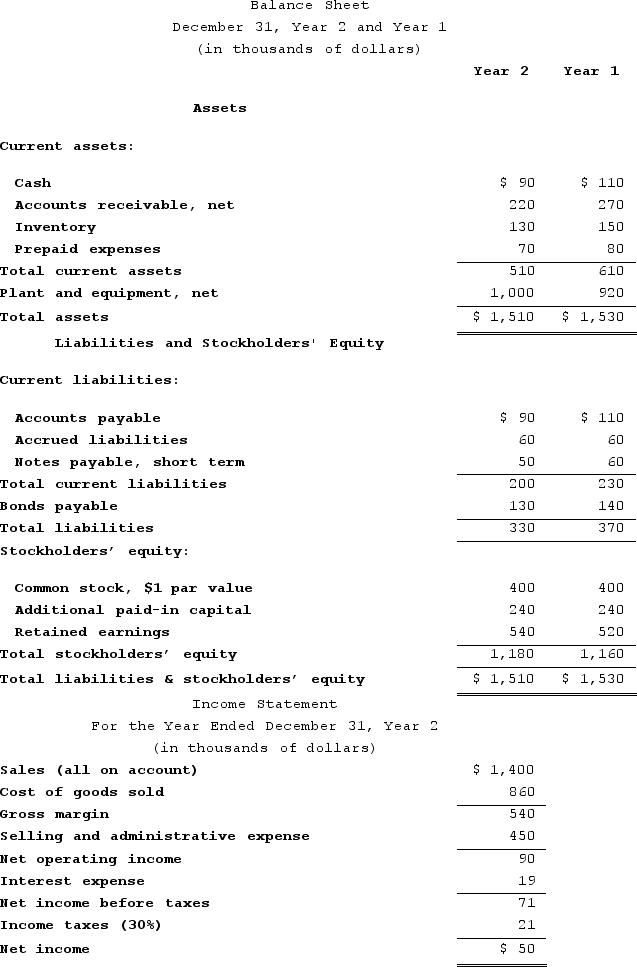

Wegener Corporation's most recent balance sheet and income statement appear below:

Required:Compute the following for Year 2:a. Working capital.b. Current ratio.c. Acid-test (quick) ratio.d. Accounts receivable turnover.e. Average collection period.f. Inventory turnover.g. Average sale period.

Required:Compute the following for Year 2:a. Working capital.b. Current ratio.c. Acid-test (quick) ratio.d. Accounts receivable turnover.e. Average collection period.f. Inventory turnover.g. Average sale period.

Working Capital

A financial metric representing the operational liquidity available to a business, calculated as current assets minus current liabilities.

Current Ratio

A liquidity ratio measuring a company's ability to pay short-term obligations, calculated as current assets divided by current liabilities.

Acid-Test Ratio

A financial metric used to determine a company's short-term liquidity, calculating its ability to pay off short-term obligations without selling inventory.

- Mastery in determining a business's immediate fiscal health by analyzing working capital, current ratio, and acid-test ratio.

- Capability to gauge a firm's operational effectiveness through the lens of turnover ratios.

Verified Answer

Learning Objectives

- Mastery in determining a business's immediate fiscal health by analyzing working capital, current ratio, and acid-test ratio.

- Capability to gauge a firm's operational effectiveness through the lens of turnover ratios.

Related questions

Abdool Corporation Has Provided the Following Financial Data ...

Arkin Corporation's Total Current Assets Are $290,000, Its Noncurrent Assets ...

Hyrkas Corporation's Most Recent Balance Sheet and Income Statement Appear ...

Steinkraus Corporation Has Provided the Following Data ...

Gremel Corporation Has Provided the Following Financial Data ...