Asked by OfficialAuzzi Clitnovici on May 30, 2024

Verified

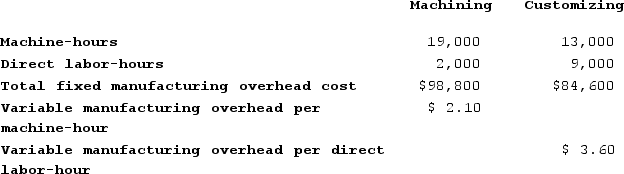

Bulla Corporation has two production departments, Machining and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

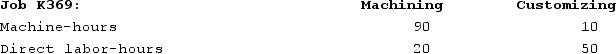

During the current month the company started and finished Job K369. The following data were recorded for this job:

During the current month the company started and finished Job K369. The following data were recorded for this job:

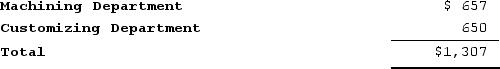

Required:Calculate the total amount of overhead applied to Job K369 in both departments. (Do not round intermediate calculations.)

Required:Calculate the total amount of overhead applied to Job K369 in both departments. (Do not round intermediate calculations.)

Predetermined Overhead Rate

A rate established in advance to allocate overhead costs to products or services based on a specific activity base.

Machine-Hours

A measure of production time where one machine-hour equals the operation of one machine for one hour.

Direct Labor-Hours

The total hours worked by employees directly involved in the manufacturing process, used as a base for allocating overhead costs to products.

- Infer the application of manufacturing overhead on jobs, anchored by machine hours and labor hours.

Verified Answer

Learning Objectives

- Infer the application of manufacturing overhead on jobs, anchored by machine hours and labor hours.

Related questions

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Madole Corporation Has Two Production Departments, Forming and Customizing ...

Dancel Corporation Has Two Production Departments, Milling and Finishing ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Vasilopoulos Corporation Has Two Production Departments, Casting and Assembly ...