Asked by Jhane Hemingway on May 08, 2024

Verified

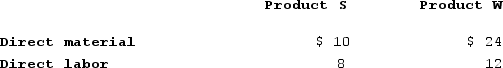

EMD Corporation manufactures two products, Product S and Product W. Product W is of fairly recent origin, having been developed as an attempt to enter a market closely related to that of Product W. Product W is the more complex of the two products, requiring one hour of direct labor time per unit to manufacture compared to one-half hour of direct labor time for Product S. Product W is produced on an automated production line.Overhead is currently assigned to the products on the basis of direct-labor-hours. The company estimated it would incur $500,000 in manufacturing overhead costs and produce 10,000 units of Product W and 60,000 units of Product S during the current year. Unit cost for materials and direct labor are:

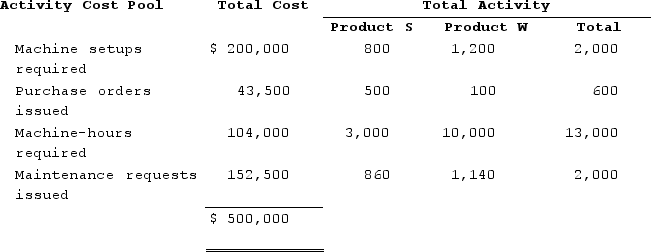

Required:a. Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year.b. The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below:

Required:a. Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year.b. The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below:

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

Direct Labor

involves labor costs directly associated with the manufacturing of products, easily traceable to the end product.

Overhead Costs

Expenses related to the operation of a business that are not directly tied to a specific product or service, such as rent, utilities, and administrative expenses.

- Acquire a comprehension of the Activity-Based Costing (ABC) methodology.

- Assign overhead expenditures to goods using determined activity rates.

- Establish the profitability boundaries of products via ABC analytic methods.

Verified Answer

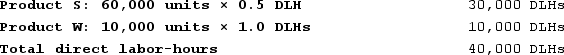

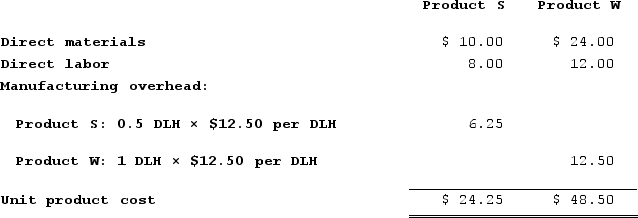

Using these hours as a base, the predetermined overhead using direct labor-hours would be:Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base =$500,000 ÷ 40,000 DLHs = $12.50 per DLHUsing this overhead rate, the unit product cost of each product would be:

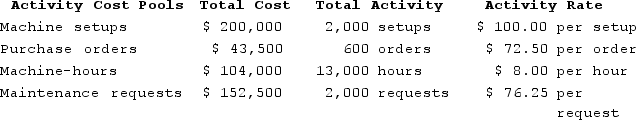

Using these hours as a base, the predetermined overhead using direct labor-hours would be:Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base =$500,000 ÷ 40,000 DLHs = $12.50 per DLHUsing this overhead rate, the unit product cost of each product would be: b.The overhead rates are computed as follows:

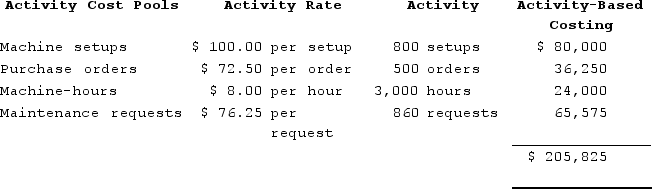

b.The overhead rates are computed as follows: The overhead cost charged to each product is:The overhead cost charged to Product S is:

The overhead cost charged to each product is:The overhead cost charged to Product S is: Overhead cost per unit of Product S = $205,825 ÷ 60,000 units = $3.43 per unit (rounded)The overhead cost charged to Product W is:

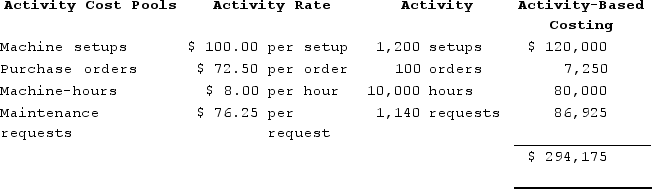

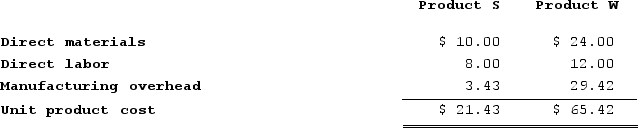

Overhead cost per unit of Product S = $205,825 ÷ 60,000 units = $3.43 per unit (rounded)The overhead cost charged to Product W is: Overhead cost per unit of Product W = $294,175 ÷ 10,000 units = $29.42 per unit (rounded)Using activity-based costing, the unit product cost of each product would be:

Overhead cost per unit of Product W = $294,175 ÷ 10,000 units = $29.42 per unit (rounded)Using activity-based costing, the unit product cost of each product would be:

Learning Objectives

- Acquire a comprehension of the Activity-Based Costing (ABC) methodology.

- Assign overhead expenditures to goods using determined activity rates.

- Establish the profitability boundaries of products via ABC analytic methods.

Related questions

Dane Housecleaning Provides Housecleaning Services to Its Clients ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Greife Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...