Asked by elena gonzalez on Apr 26, 2024

Verified

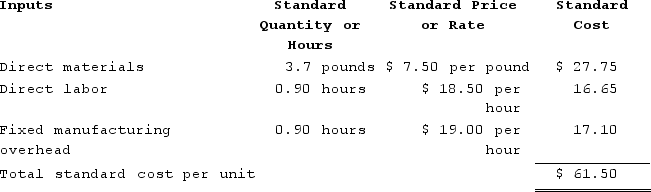

Herriot Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $598,500 and budgeted activity of 31,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $598,500 and budgeted activity of 31,500 hours.

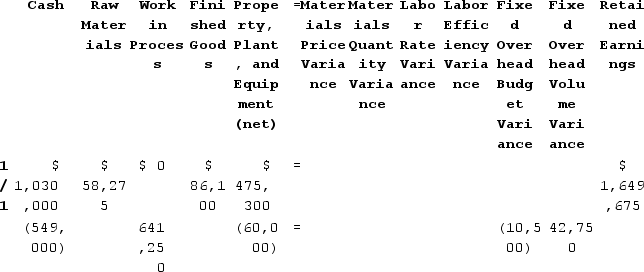

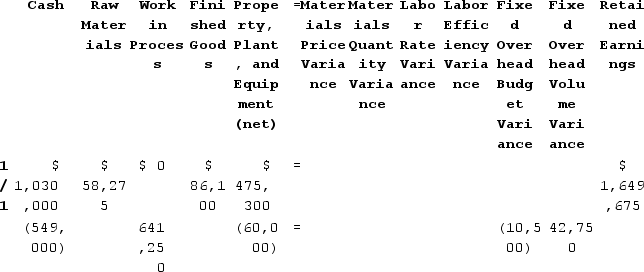

During the year, the company applied fixed overhead to the 37,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $609,000. Of this total, $549,000 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $60,000 related to depreciation of manufacturing equipment.

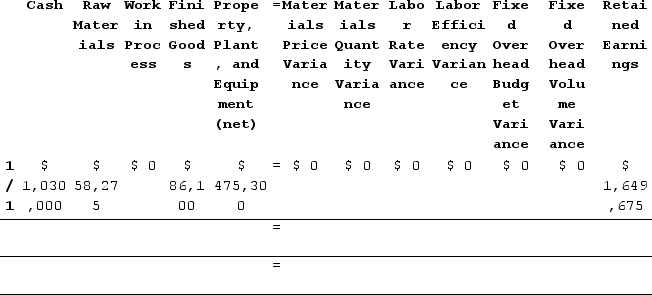

Required:Completely record the transactions involving fixed overhead, including any variances, in the worksheet that appears below. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

Fixed Overhead

Costs that do not vary with the level of production or sales, including rent, salaries, and insurance, necessary for maintaining a business’s operations.

Direct Labor-Hours

A unit of measure representing the actual hours worked by employees directly involved in the production process.

Depreciation

A structured approach to spreading out the cost of a solid asset over the period it is expected to be useful.

- Master the art of recording transactions accurately within a standard costing system.

- Foster the capability to scrutinize disparities between planned expenses and real costs, relating to direct materials, direct labor, and fixed overhead.

- Familiarize yourself with the process of assigning fixed overhead costs to Work in Process (WIP) inventory through the predetermined overhead rate.

Verified Answer

OL

Octavio LimpiasApr 26, 2024

Final Answer :

Budget variance = Actual fixed overhead − Budgeted fixed overhead= $609,000 − $598,500= $10,500 UnfavorableVolume variance = Budgeted fixed overhead − Fixed overhead applied to work in process= $598,500 − (33,750 hours × $19.00 per hour)= $598,500 − ($641,250)= $42,750 Favorable

Cash decreases by the actual amount paid for various fixed overhead costs, which is $549,000. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (37,500 units × 0.90 hours per unit) × $19.00 per hour = 33,750 hours × $19.00 per hour = $641,250. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $60,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $10,500 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $42,750 Favorable.

Cash decreases by the actual amount paid for various fixed overhead costs, which is $549,000. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (37,500 units × 0.90 hours per unit) × $19.00 per hour = 33,750 hours × $19.00 per hour = $641,250. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $60,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $10,500 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $42,750 Favorable.

Cash decreases by the actual amount paid for various fixed overhead costs, which is $549,000. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (37,500 units × 0.90 hours per unit) × $19.00 per hour = 33,750 hours × $19.00 per hour = $641,250. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $60,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $10,500 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $42,750 Favorable.

Cash decreases by the actual amount paid for various fixed overhead costs, which is $549,000. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (37,500 units × 0.90 hours per unit) × $19.00 per hour = 33,750 hours × $19.00 per hour = $641,250. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $60,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $10,500 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $42,750 Favorable.

Learning Objectives

- Master the art of recording transactions accurately within a standard costing system.

- Foster the capability to scrutinize disparities between planned expenses and real costs, relating to direct materials, direct labor, and fixed overhead.

- Familiarize yourself with the process of assigning fixed overhead costs to Work in Process (WIP) inventory through the predetermined overhead rate.