Asked by McGwire Midkiff on May 20, 2024

Verified

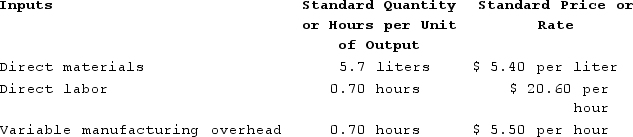

Fluegge Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.  The company has reported the following actual results for the product for December:

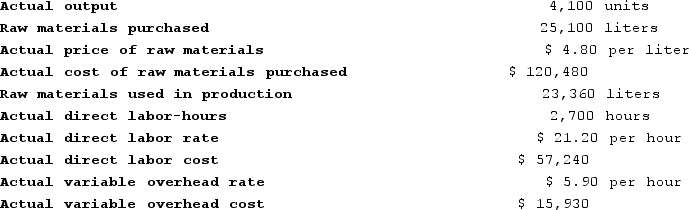

The company has reported the following actual results for the product for December:

The raw materials price variance for the month is closest to:

The raw materials price variance for the month is closest to:

A) $15,060 Unfavorable

B) $14,016 Favorable

C) $15,060 Favorable

D) $14,016 Unfavorable

Raw Materials Price Variance

The difference between the actual cost of raw materials and the standard cost multiplied by the actual quantity used.

- Measure the differences in materials' quantity and pricing to evaluate how effectively materials are used and costs are managed.

Verified Answer

MF

MBA FT 2018-20

May 21, 2024

Final Answer :

C

Explanation :

Raw Materials Cost Variance can be calculated using the following formula:

Actual Quantity Purchased (AQ) x (Actual Price (AP) - Standard Price (SP))

For the given information,

AQ = 18,000 pounds

AP = $5.20 per pound

SP = $5.60 per pound

Raw Materials Cost Variance = 18,000 x ($5.20 - $5.60) = $15,060 Favorable.

Therefore, the correct answer is C.

Actual Quantity Purchased (AQ) x (Actual Price (AP) - Standard Price (SP))

For the given information,

AQ = 18,000 pounds

AP = $5.20 per pound

SP = $5.60 per pound

Raw Materials Cost Variance = 18,000 x ($5.20 - $5.60) = $15,060 Favorable.

Therefore, the correct answer is C.

Learning Objectives

- Measure the differences in materials' quantity and pricing to evaluate how effectively materials are used and costs are managed.

Related questions

The Raw Materials Price Variance for the Month Is Closest ...

The Raw Materials Quantity Variance for the Month Is Closest ...

Klacic Corporation Makes a Product with the Following Standard Costs ...

Heye Incorporated Has Provided the Following Data Concerning One of ...

Camps Incorporated Has a Standard Cost System ...