Asked by Noelle Buban on May 12, 2024

Verified

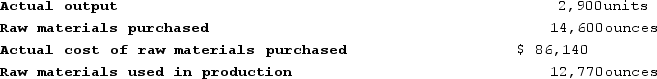

Camps Incorporated has a standard cost system. The standards for direct materials for one of its products specify 4.4 ounces of a particular input per unit of output at a standard cost of $6.40 per ounce. The company has reported the following actual results for the product for May:

Required:

Required:

a. Compute the materials price variance for this input for May.

b. Compute the materials quantity variance for this input for May.

Materials Price Variance

The difference between the actual cost of materials used in production and the expected (or budgeted) cost.

Materials Quantity Variance

The difference between the actual quantity of materials used in production and the standard amount expected to be used, multiplied by the standard cost per unit.

- Identify the variance in expenses between actual and budgeted costs for direct materials and direct labor.

- Explore and decode the variance in price and quantity for materials.

Verified Answer

KP

Keith PerkinsMay 15, 2024

Final Answer :

a. Materials price variance = (Actual quantity × Actual price) − (Actual quantity × Standard price)

= $86,140 − (14,600 ounces × $6.40 per ounce)

= $86,140 − $93,440

= $7,300 Favorable

b. Standard quantity = 2,900 units × 4.4 ounces per unit = 12,760 ounces

Materials quantity variance = (Actual quantity × Standard price) − (Standard quantity × Standard price)

= (Actual quantity − Standard quantity) × Standard price

= (12,770 ounces − 12,760 ounces) × $6.40 per ounce

= 10 ounces × $6.40 per ounce

= $64 Unfavorable

= $86,140 − (14,600 ounces × $6.40 per ounce)

= $86,140 − $93,440

= $7,300 Favorable

b. Standard quantity = 2,900 units × 4.4 ounces per unit = 12,760 ounces

Materials quantity variance = (Actual quantity × Standard price) − (Standard quantity × Standard price)

= (Actual quantity − Standard quantity) × Standard price

= (12,770 ounces − 12,760 ounces) × $6.40 per ounce

= 10 ounces × $6.40 per ounce

= $64 Unfavorable

Learning Objectives

- Identify the variance in expenses between actual and budgeted costs for direct materials and direct labor.

- Explore and decode the variance in price and quantity for materials.

Related questions

A Partial Standard Cost Card for the Single Product Produced ...

Klacic Corporation Makes a Product with the Following Standard Costs ...

Kropf Incorporated Has Provided the Following Data Concerning One of ...

Doby Corporation Makes a Product with the Following Standard Costs ...

Lido Company's Standard and Actual Costs Per Unit for the ...