Asked by diksha pathria on May 06, 2024

Verified

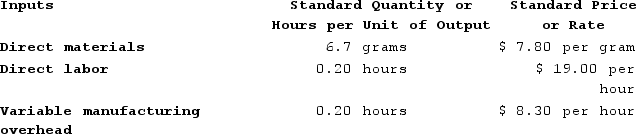

Heye Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

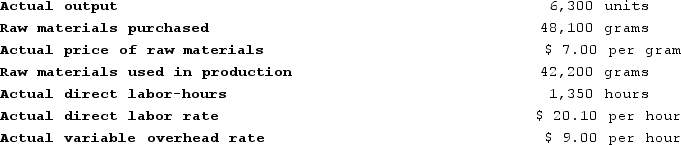

The company has reported the following actual results for the product for August:

The company has reported the following actual results for the product for August:

Required:

Required:

a. Compute the materials price variance for August.

b. Compute the materials quantity variance for August.

c. Compute the labor rate variance for August.

d. Compute the labor efficiency variance for August.

e. Compute the variable overhead rate variance for August.

f. Compute the variable overhead efficiency variance for August.

Materials Quantity Variance

The difference between the actual and the standard amount of materials used in production, valued at the standard cost.

Labor Rate Variance

The difference between the actual cost of labor and the budgeted or standard cost, often used in budgeting and cost management.

Variable Overhead Rate Variance

The difference between the actual variable overheads incurred and the expected variable overheads based on standard rates.

- Assess the divergence between standard and actual costs for direct materials and direct labor.

- Scrutinize and interpret variations in materials cost and quantity.

- Gauge and expound upon the disparities in direct labor rate and efficiency.

Verified Answer

May 10, 2024

= Actual quantity × (Actual price − Standard price)

= 48,100 grams × ($7.00 per gram − $7.80 per gram)

= 48,100 grams × (−$0.80 per gram)

= $38,480 Favorable

b. Standard quantity = 6,300 units × 6.7 grams per unit = 42,210 grams

Materials quantity variance = (Actual quantity × Standard price) − (Standard quantity × Standard price)

= (Actual quantity − Standard quantity) × Standard price

= (42,200 grams − 42,210 grams) × $7.80 per gram

= −10 grams × $7.80 per gram

= $78 Favorable

c. Labor rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 1,350 hours × ($20.10 per hour − $19.00 per hour)

= 1,350 hours × ($1.10 per hour)

= $1,485 Unfavorable

d. Standard hours = 6,300 units × 0.20 hours per unit = 1,260 hours

Labor efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,350 hours − 1,260 hours) × $19.00 per hour

= (90 hours) × $19.00 per hour

= $1,710 Unfavorable

e. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 1,350 hours × ($9.00 per hour − $8.30 per hour)

= 1,350 hours × ($0.70 per hour)

= $945 Unfavorable

f. Standard hours = 6,300 units × 0.20 hours per unit = 1,260 hours

Variable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,350 hours − 1,260 hours) × $8.30 per hour

= (90 hours) × $8.30 per hour

= $747 Unfavorable

Learning Objectives

- Assess the divergence between standard and actual costs for direct materials and direct labor.

- Scrutinize and interpret variations in materials cost and quantity.

- Gauge and expound upon the disparities in direct labor rate and efficiency.

Related questions

Kropf Incorporated Has Provided the Following Data Concerning One of ...

The Following Data Have Been Provided by Lopus Corporation ...

Sakelaris Corporation Makes a Product with the Following Standard Costs ...

Becka Incorporated Has Provided the Following Data Concerning One of ...

The Standards for Product V28 Call for 8 ...