Asked by Pinky Melon on May 01, 2024

Verified

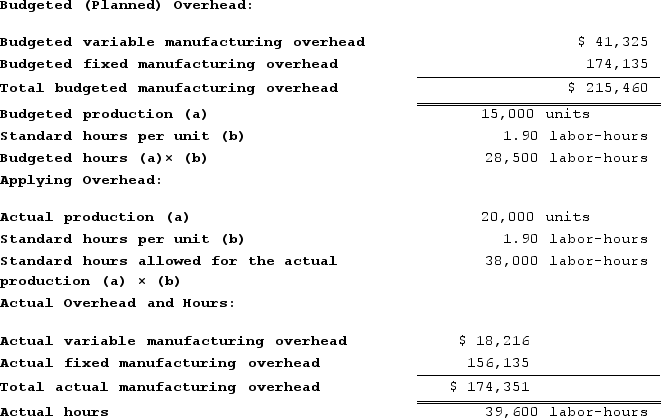

Edlow Incorporated makes a single product--a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

a. Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

Variable Overhead Rate

A rate used to assign variable overhead costs to units of production, based on an activity driver such as labor hours or machine hours, fluctuating with changes in production activity.

Overhead Efficiency

The effectiveness with which a business uses its overhead expenses to produce goods or services.

Fixed Overhead Budget

A forecast of the fixed costs that a company expects to incur over a certain period, helping in planning and controlling expenses.

- Work out distinct variances regarding manufacturing overhead, encompassing budget, volume, rate, and efficiency variances.

Verified Answer

= $1.45 per labor-hour

Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= ($18,216) − (39,600 labor-hours × $1.45 per labor-hour)

= ($18,216) − ($57,420)

= $39,204 Favorable

b. Labor efficiency variance = (Actual hours − Standard hours) × Standard rate

= (39,600 labor-hours − 38,000 labor-hours) × $1.45 per labor-hour

= (1,600 labor-hours) × $1.45 per labor-hour

= $2,320 Unfavorable

c. Budget variance = Actual fixed overhead − Budgeted fixed overhead

= $156,135 − $174,135 = $18,000 Favorable

d. Fixed component of the predetermined overhead rate = $174,135/28,500 labor-hours

= $6.11 per labor-hour

Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $174,135 − ($6.11 per labor-hour × 38,000 labor-hours)

= $174,135 − ($232,180)

= $58,045 Favorable

Learning Objectives

- Work out distinct variances regarding manufacturing overhead, encompassing budget, volume, rate, and efficiency variances.

Related questions

You Have Just Been Hired as the Controller of the ...

Emanuele Incorporated Makes a Single Product--A Critical Part Used in ...

Warrenfeltz Incorporated Makes a Single Product--A Cooling Coil Used in ...

Held Incorporated Makes a Single Product--An Electrical Motor Used in ...

Eastern Company Uses a Standard Cost System in Which Manufacturing ...