Asked by Elmer Trejo on May 17, 2024

Verified

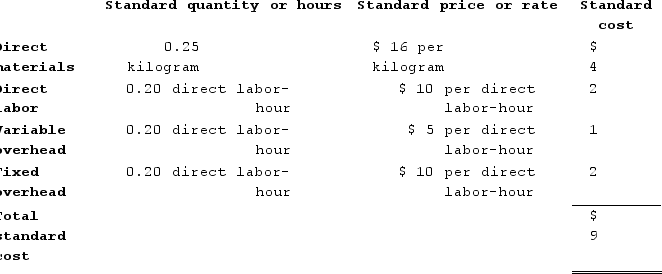

Eastern Company uses a standard cost system in which manufacturing overhead is applied to units of product on the basis of standard direct labor-hours. The denominator activity level is 60,000 direct labor-hours, or 300,000 units. A standard cost card for the company's product follows:

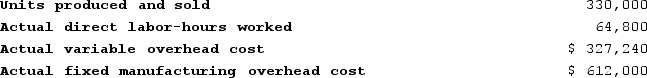

Actual data for the year follow:

Actual data for the year follow:

Required:

Required:

a.Compute the variable overhead rate and efficiency variances.

b. Compute the fixed manufacturing overhead budget and volume variances.

Variable Overhead Rate

The per-unit cost of overhead that changes with the level of production or activity.

Efficiency Variances

The differences between actual costs and the standard or budgeted costs based on the efficient use of resources.

Fixed Manufacturing Overhead Budget

A predetermined estimate of the total fixed costs required to support production activities, excluding variable costs directly tied to production volume.

- Determine a diversity of variances related to manufacturing overhead, consisting of budget, volume, rate, and efficiency variances.

Verified Answer

Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= $327,240 − (64,800 direct labor-hours × $5.00 per direct labor-hour)

= $327,240 − $324,000

= $3,240 Unfavorable

Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate

= (64,800 direct labor-hours − 66,000 direct labor-hours*) × $5.00 per direct labor-hour

= (−1,200 direct labor-hours) × $5.00 per direct labor-hour

= $6,000 Favorable

* 330,000 units × 0.20 direct labor-hour per unit = 66,000 direct labor-hours

b. Fixed overhead variances:

Budget variance = Actual fixed manufacturing overhead − Budgeted fixed manufacturing overhead

= $612,000 − $600,000

= $12,000 Unfavorable

Volume variance = Fixed component of the predetermined overhead rate × (Denominator hours − Standard hours allowed for the actual output)

= $10.00 per direct labor-hour × (60,000 direct labor-hours − 66,000 direct labor-hours)

= $10.00 per direct labor-hour × (−6,000 direct labor-hours)

= $60,000 Favorable

Learning Objectives

- Determine a diversity of variances related to manufacturing overhead, consisting of budget, volume, rate, and efficiency variances.

Related questions

Berk Incorporated Makes a Single Product--A Critical Part Used in ...

Emanuele Incorporated Makes a Single Product--A Critical Part Used in ...

You Have Just Been Hired as the Controller of the ...

Modine Corporation Has Provided the Following Data for September ...

Held Incorporated Makes a Single Product--An Electrical Motor Used in ...