Asked by Christian DelaRosa on Jun 14, 2024

Verified

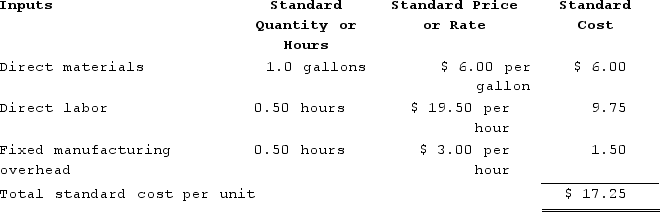

Eagan Corporation manufactures one product. The company uses a standard cost system in which inventories are recorded at their standard costs. The standard cost card for the company's only product is as follows:

During the year, direct labor workers (who were paid in cash) worked 11,250 hours at an average cost of $19.70 per hour on 22,300 units. These units were started and completed during the year.

During the year, direct labor workers (who were paid in cash) worked 11,250 hours at an average cost of $19.70 per hour on 22,300 units. These units were started and completed during the year.

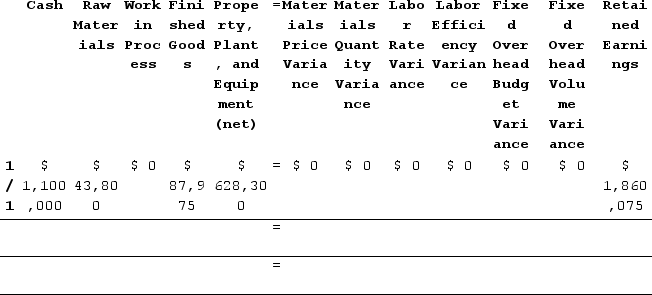

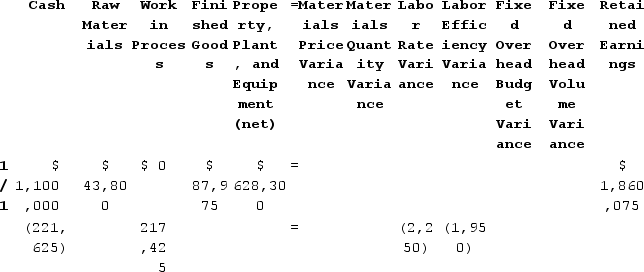

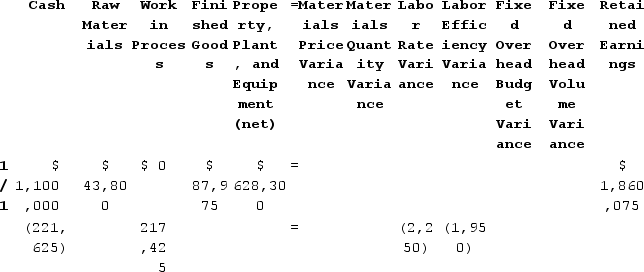

Required:Completely record the direct labor costs, along with any direct labor variances, in the below worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

Direct Labor Variances

The differences between the actual labor costs incurred and the standard labor costs for the actual production achieved.

Direct Labor Costs

The wages paid to employees who are directly involved in the production of goods or services, such as assembly line workers or craftsmen.

Standard Costs

Predetermined or estimated costs to perform an operation or produce a good, used as benchmarks against actual costs.

- Understand the key concepts and classifications within standard costing, including the distinction between direct materials, direct labor, and fixed overhead.

- Achieve proficiency in evaluating the gap between real and estimated costs, especially in terms of direct materials, direct labor, and fixed overhead variances.

Verified Answer

SH

Souhail HamdyJun 16, 2024

Final Answer :

Labor rate variance = Actual hours × (Actual rate − Standard rate)= 11,250 hours × ($19.70 per hour − $19.50 per hour)= 11,250 hours × ($0.20 per hour)= $2,250 UnfavorableLabor efficiency variance:Standard hours = Actual output × Standard quantity = 22,300 units × 0.50 hours per unit = 11,150 hoursLabor efficiency variance = (Actual hours − Standard hours) × Standard rate= (11,250 hours − 11,150 hours) × $19.50 per hour= (100 hours) × $19.50 per hour= $1,950 Unfavorable

Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 11,250 hours × $19.70 per hour = $221,625. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (22,300 units × 0.50 hours per unit) × $19.50 per hour = 11,150 hours × $19.50 per hour = $217,425. The difference consists of the Labor Rate Variance which is $2,250 Unfavorable and the Labor Efficiency Variance which is $1,950 Unfavorable.

Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 11,250 hours × $19.70 per hour = $221,625. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (22,300 units × 0.50 hours per unit) × $19.50 per hour = 11,150 hours × $19.50 per hour = $217,425. The difference consists of the Labor Rate Variance which is $2,250 Unfavorable and the Labor Efficiency Variance which is $1,950 Unfavorable.

Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 11,250 hours × $19.70 per hour = $221,625. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (22,300 units × 0.50 hours per unit) × $19.50 per hour = 11,150 hours × $19.50 per hour = $217,425. The difference consists of the Labor Rate Variance which is $2,250 Unfavorable and the Labor Efficiency Variance which is $1,950 Unfavorable.

Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 11,250 hours × $19.70 per hour = $221,625. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (22,300 units × 0.50 hours per unit) × $19.50 per hour = 11,150 hours × $19.50 per hour = $217,425. The difference consists of the Labor Rate Variance which is $2,250 Unfavorable and the Labor Efficiency Variance which is $1,950 Unfavorable.

Learning Objectives

- Understand the key concepts and classifications within standard costing, including the distinction between direct materials, direct labor, and fixed overhead.

- Achieve proficiency in evaluating the gap between real and estimated costs, especially in terms of direct materials, direct labor, and fixed overhead variances.