Asked by Kayla Lippoldt on Jun 17, 2024

Verified

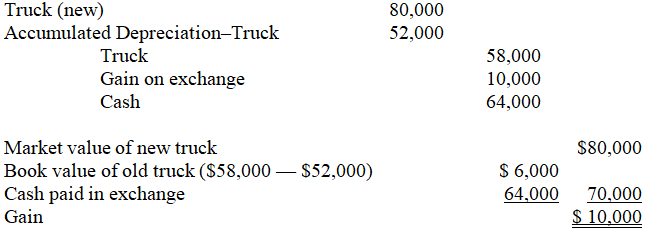

During the current year,a company exchanged an old truck costing $58,000 with accumulated depreciation of $52,000 for a new truck.The new truck had a cash price of $80,000 and the company received a $16,000 trade-in allowance on the old truck with the balance of $64,000 paid in cash.Prepare the journal entry to record the exchange,assuming the transaction has commercial substance.

Trade-In Allowance

An amount credited to the buyer by the seller for a trade-in, which is applied to the purchase price of a new item.

Accumulated Depreciation

The total depreciation for a fixed asset that has been charged to expense since that asset was acquired and made available for use.

Cash Price

The price of an item for immediate payment, as opposed to a higher price when paying on credit.

- Chronicle the exchanges involving assets of varying similarity that carry commercial substance.

- Formulate entries in the general journal for the purpose of recording plant asset transactions.

Verified Answer

AF

Learning Objectives

- Chronicle the exchanges involving assets of varying similarity that carry commercial substance.

- Formulate entries in the general journal for the purpose of recording plant asset transactions.