Asked by Mauricio Davila on Jun 16, 2024

Verified

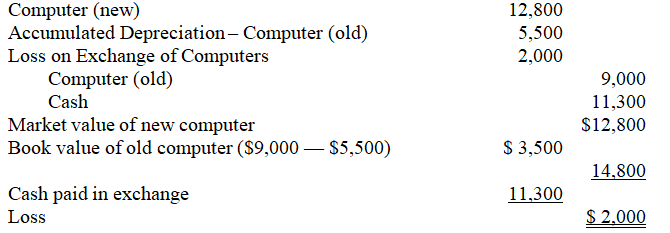

During the current year,Beldon Co.acquired a new computer with a cash price of $12,800 by exchanging an old one on which the company received a $1,500 trade-in allowance (with the balance of $11,300 paid in cash).The old computer cost $9,000 and its accumulated depreciation was $5,500 as of the exchange date.Assuming the exchange transaction had commercial substance,prepare the journal entry to record the exchange.

Trade-In Allowance

The credit offered by a seller for an old item that is given as part of the payment for a new item, reducing the cash needed to complete the new purchase.

Accumulated Depreciation

This refers to the total amount of depreciation expense that has been recorded for an asset since it was acquired, reflecting its decrease in value over time.

Cash Price

The amount of money required to purchase a good or service using cash, as opposed to credit terms or financing.

- Note down transactions of assets, whether similar or dissimilar, that have a commercial relevance.

- Assemble general journal entries to chronicle transactions linked to plant assets.

Verified Answer

AH

Learning Objectives

- Note down transactions of assets, whether similar or dissimilar, that have a commercial relevance.

- Assemble general journal entries to chronicle transactions linked to plant assets.