Asked by Luisa Fernanda Bohorquez on Jun 11, 2024

Verified

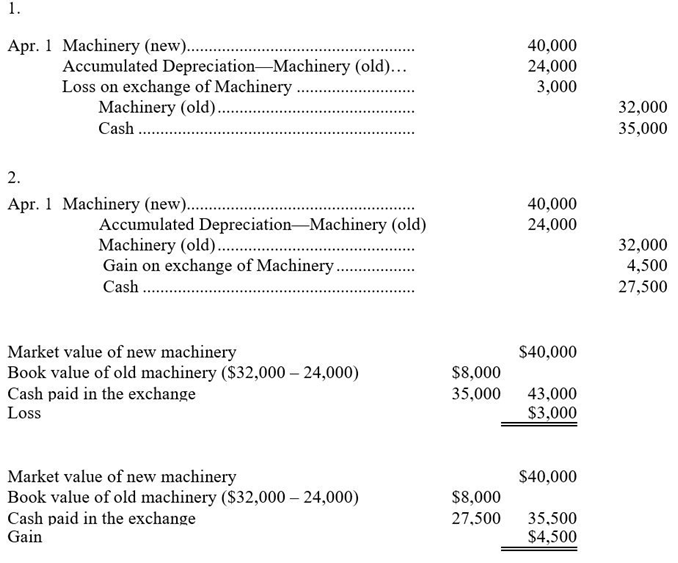

On April 1 of the current year,a company traded an old machine that originally cost $32,000 and that had accumulated depreciation of $24,000 for a similar new machine that had a cash price of $40,000.

1.Prepare the entry to record the exchange under the assumption that a $5,000 trade-in allowance was received and the balance of $35,000 was paid in cash.Assume the exchange transaction had commercial substance.

2.Prepare the entry to record the exchange under the assumption that instead of a $5,000 trade-in allowance,a $12,500 trade-in allowance was received and the balance of $27,500 was paid in cash.Assume the exchange transaction has commercial substance.

Trade-In Allowance

The credit a buyer receives for a previous item towards the purchase of a new item.

Accumulated Depreciation

The total amount of a tangible asset's cost that has been allocated as depreciation expense over its useful life.

Commercial Substance

A concept in accounting that indicates a transaction has significantly changed the economic conditions or the cash flows of an entity.

- Catalogue the transactions involving the exchange of assets with and without similarity that possess commercial importance.

- Generate entries in the general ledger to document transactions associated with plant assets.

Verified Answer

KS

Learning Objectives

- Catalogue the transactions involving the exchange of assets with and without similarity that possess commercial importance.

- Generate entries in the general ledger to document transactions associated with plant assets.