Asked by A Breath of Mahek on Jun 21, 2024

Verified

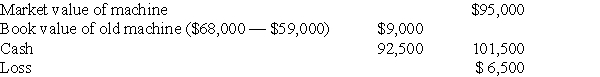

A company exchanged its used machine for a new machine in a transaction that had commercial substance.The old machine cost $68,000,and the new one had a cash price of $95,000.The company had taken $59,000 depreciation on the old machine and was allowed a $2,500 trade-in allowance and the balance of $92,500 was paid in cash.What gain or loss should be recorded on the exchange?

Commercial Substance

An occurrence in a transaction where the future cash flows or the economic circumstances of the involved parties change as a result.

Trade-In Allowance

The discount or credit granted for the return of an old item when purchasing a new one.

Depreciation

The allocation of the cost of a tangible asset over its useful life, representing the decrease in value due to wear and tear, age, or obsolescence.

- Log the dealings of similar and dissimilar assets which hold commercial significance.

- Construct entries in the general journal to capture transactions concerning plant assets.

Verified Answer

MS

Learning Objectives

- Log the dealings of similar and dissimilar assets which hold commercial significance.

- Construct entries in the general journal to capture transactions concerning plant assets.