Asked by Rosiee Adwoa on May 30, 2024

Verified

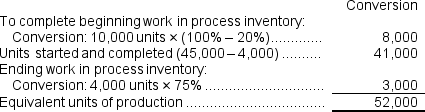

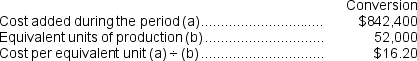

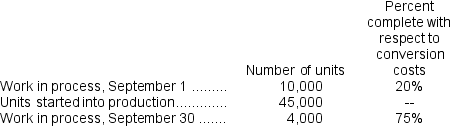

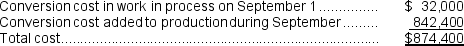

Dorman Music Corporation manufactures guitars and uses a FIFO process costing system.The following information relates to September production:

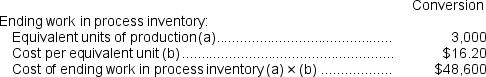

The amount of conversion cost that should be assigned to the guitars in work in process on September 30 is closest to:

The amount of conversion cost that should be assigned to the guitars in work in process on September 30 is closest to:

A) $48,600

B) $874,400

C) $842,400

D) $48,000

FIFO Method

An inventory valuation method where the oldest inventory items are recorded as sold first, leaving the newest items in inventory.

Conversion Cost

Combined costs of direct labor and manufacturing overheads incurred to convert raw materials into finished goods.

Work in Process

includes products that are in the production process but are not yet completed.

- Analyze functional data to estimate equivalent units of production related to materials and conversion fees.

- Evaluate the cost per equivalent unit with the use of the FIFO technique.

Verified Answer

Learning Objectives

- Analyze functional data to estimate equivalent units of production related to materials and conversion fees.

- Evaluate the cost per equivalent unit with the use of the FIFO technique.

Related questions

Laurant Corporation Uses the FIFO Method in Its Process Costing ...

Intask Corporation Uses the FIFO Method in Its Process Costing ...

Salmont Corporation Uses the FIFO Method in Its Process Costing ...

Tabet Corporation Uses the FIFO Method in Its Process Costing ...

What Were the Equivalent Units of Production for Conversion Costs ...