Asked by Devyn Murray on May 02, 2024

Verified

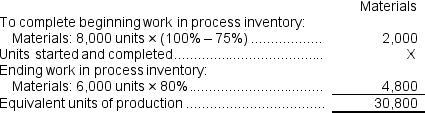

Salmont Corporation uses the FIFO method in its process costing system.The company reported 30,800 equivalent units of production for materials last month.The company's beginning work in process inventory consisted of 8,000 units, 75% complete with respect to materials.The ending work in process inventory consisted of 6,000 units, 80% complete with respect to materials.The number of units started during the month was:

A) 32,000 units

B) 24,000 units

C) 6,800 units

D) 30,000 units

FIFO Method

An inventory valuation method that assumes items purchased or produced first are sold first, standing for "First-In, First-Out".

Equivalent Units

A term used in cost accounting to denote a conversion of partially completed goods to an equivalent number of fully completed units.

Process Costing

A costing method used when identical or similar items are mass-produced, allocating costs based on the process or departments through which the products pass.

- Scrutinize operational records to determine equivalent units of manufacturing for both materials and conversion outlays.

Verified Answer

FIFO method equivalent units of production

2,000 + X + 4,800 = 30,800

2,000 + X + 4,800 = 30,800X = 30,800 - 2,000 - 4,800 = 24,000

Units started and completed = Units started into production during the period - Units in ending inventory

24,000 = Units started into production during the period - 6,000

Units started into production during the period = 24,000 + 6,000 = 30,000

Learning Objectives

- Scrutinize operational records to determine equivalent units of manufacturing for both materials and conversion outlays.

Related questions

Dorman Music Corporation Manufactures Guitars and Uses a FIFO Process ...

Intask Corporation Uses the FIFO Method in Its Process Costing ...

Laurant Corporation Uses the FIFO Method in Its Process Costing ...

Which of the Following Is Not a Necessary Step in ...

The Equivalent Units for February for Conversion Costs Were