Asked by Surinder Gujral on Jul 06, 2024

Verified

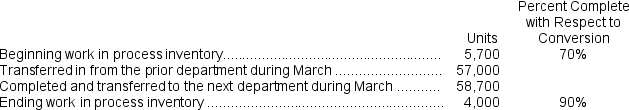

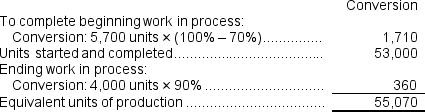

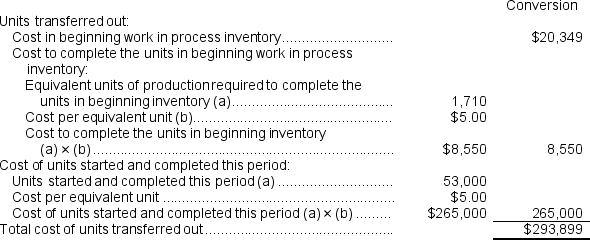

Tabet Corporation uses the FIFO method in its process costing system.Operating data for the Curing Department for the month of March appear below:  According to the company's records, the conversion cost in beginning work in process inventory was $20,349 at the beginning of March.The cost per equivalent unit for conversion costs for March was $5.00. How much conversion cost would be assigned to the units completed and transferred out of the department during March?

According to the company's records, the conversion cost in beginning work in process inventory was $20,349 at the beginning of March.The cost per equivalent unit for conversion costs for March was $5.00. How much conversion cost would be assigned to the units completed and transferred out of the department during March?

A) $273,550

B) $293,899

C) $285,000

D) $293,500

FIFO Method

An inventory valuation method that assumes items bought or manufactured first are sold first, standing for "First In, First Out."

Conversion Costs

The combined costs of direct labor and manufacturing overhead incurred to convert raw materials into finished goods.

Curing Department

A specific department in a manufacturing process, especially in industries like rubber or tobacco, responsible for the curing phase, which involves controlled drying or chemical treatments.

- Compute the per-unit cost using the FIFO strategy.

Verified Answer

Units started and completed during the period = Units started into production during the period - Units in ending work in process inventory = 57,000 - 4,000 = 53,000

Learning Objectives

- Compute the per-unit cost using the FIFO strategy.

Related questions

Dorman Music Corporation Manufactures Guitars and Uses a FIFO Process ...

What Were the Equivalent Units of Production for Conversion Costs ...

Sharp Corporation Has a Process Costing System ...

Lenning Corporation Uses the First-In, First-Out Method in Its Process ...

Daosta Incorporated Uses the First-In, First-Out Method in Its Process ...