Asked by Debbie Annang on Jul 06, 2024

Verified

Intask Corporation uses the FIFO method in its process costing system.Beginning inventory in the mixing department consisted of 6,000 units that were 75% complete with respect to conversion costs.Ending work in process inventory consisted of 5,000 units that were 60% complete with respect to conversion costs.If 12,000 units were transferred to the next processing department during the period, the equivalent units of production for conversion cost would be:

A) 12,500 units

B) 10,500 units

C) 13,500 units

D) 13,000 units

FIFO Method

A method of inventory valuation where the first items purchased or produced are assumed to be the first sold, known as First-In, First-Out.

Conversion Costs

The costs of converting raw materials into finished goods, including labor and overhead expenses.

Mixing Department

A specific stage or location in the manufacturing process where ingredients or components are combined to produce a product.

- Delve into the methodology of computing equivalent units of production via the FIFO approach.

- Review operating data to deduce equivalent production metrics for materials and conversion costs.

Verified Answer

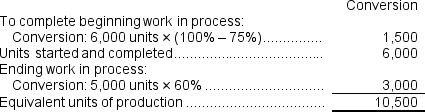

Units started and completed = 12,000

Equivalent units of beginning EWP = 6,000 x 75% = 4,500

Equivalent units of ending EWP = 5,000 x 60% = 3,000

Total equivalent units of production = units started and completed + equivalent units of beginning EWP + equivalent units of ending EWP

Total equivalent units of production = 12,000 + 4,500 + 3,000

Total equivalent units of production = 19,500

However, we are asked to calculate only the equivalent units of production for conversion costs. Therefore, the correct answer is B) 10,500 units (60% of 5,000 units in EWP + 12,000 units started and completed).

Units started and completed during the period = Units completed during the period - Units in beginning work in process inventory = 12,000 - 6,000 = 6,000

Learning Objectives

- Delve into the methodology of computing equivalent units of production via the FIFO approach.

- Review operating data to deduce equivalent production metrics for materials and conversion costs.

Related questions

Laurant Corporation Uses the FIFO Method in Its Process Costing ...

Dorman Music Corporation Manufactures Guitars and Uses a FIFO Process ...

Salmont Corporation Uses the FIFO Method in Its Process Costing ...

Compute the Equivalent Units for Direct Materials and Conversion Respectively ...

Under the First-In, First-Out Method of Product Costing, Equivalent Units ...