Asked by Timothy Hauser on Apr 29, 2024

Verified

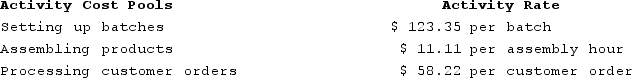

Desjarlais Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products. (Do not round intermediate calculations. Round your final answers to 2 decimal places.)

Data concerning two products appear below:

Data concerning two products appear below:

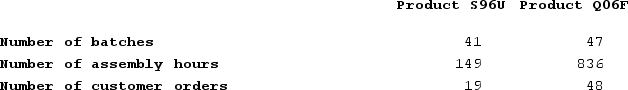

Required:a. How much overhead cost would be assigned to Product S96U using the company's activity-based costing system?b. How much overhead cost would be assigned to Product Q06F using the company's activity-based costing system?

Required:a. How much overhead cost would be assigned to Product S96U using the company's activity-based costing system?b. How much overhead cost would be assigned to Product Q06F using the company's activity-based costing system?

Activity Rates

are used in activity-based costing to allocate costs to products or services based on specific activities requiring the costs, like inspection or setup.

Activity-Based Costing

An approach to costing that apportions overhead and indirect charges to particular activities, ensuring more accurate cost determinations for products or services.

Overhead Cost

Expenses related to the general operation of a business that cannot be directly traced to a specific product or service, such as utilities and rent.

- Assimilate the principles of Activity-Based Costing (ABC).

- Assign financial overhead to products through established activity rates.

Verified Answer

Learning Objectives

- Assimilate the principles of Activity-Based Costing (ABC).

- Assign financial overhead to products through established activity rates.

Related questions

Dane Housecleaning Provides Housecleaning Services to Its Clients ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Sukhu Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Fabricating ...

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

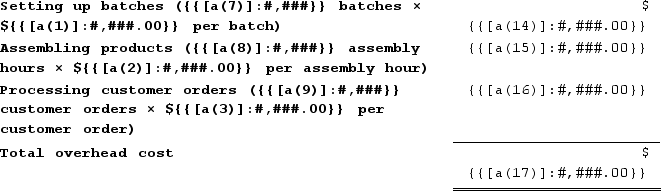

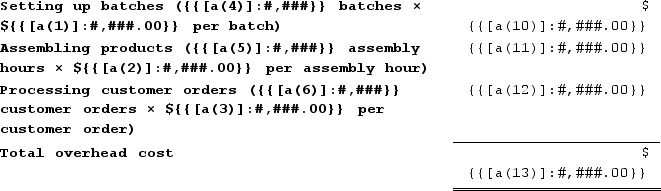

b. Product Q06F

b. Product Q06F