Asked by Luisa Zarzosa on May 09, 2024

Verified

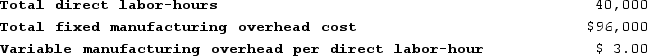

Dehner Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job P951 was completed with the following characteristics:

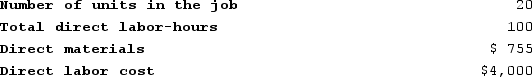

Recently, Job P951 was completed with the following characteristics:

The amount of overhead applied to Job P951 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied to Job P951 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $840

B) $300

C) $540

D) $240

Predetermined Overhead Rate

A calculated rate used to allocate manufacturing overhead costs to individual units of production, based on estimated costs and activity levels.

Direct Labor-hours

The total hours of labor directly involved in producing goods, used as a measure for costing and operational efficiency.

Manufacturing Overhead

All manufacturing costs that are not directly related to the production of goods or services, such as factory rent, utilities, and equipment maintenance.

- Work out the total overhead directed to a job using predetermined overhead rates.

- Gain insight into calculating costs per unit in a job-order cost system.

Verified Answer

Predetermined overhead rate = Estimated total overhead cost / Estimated total direct labor-hours

= $336,000 / 42,000 DLH

= $8 per DLH

Next, we need to calculate the total cost of Job P951:

Total cost = Direct materials + Direct labor + Manufacturing overhead applied

= $800 + $2,000 + $540

= $3,340

Manufacturing overhead applied = Predetermined overhead rate x Actual direct labor-hours

= $8 per DLH x 67.5 DLH

= $540

Therefore, the amount of overhead applied to Job P951 is $540, which is closest to answer choice C.

Learning Objectives

- Work out the total overhead directed to a job using predetermined overhead rates.

- Gain insight into calculating costs per unit in a job-order cost system.

Related questions

Dehner Corporation Uses a Job-Order Costing System with a Single ...

The Following Data Have Been Recorded for Recently Completed Job ...

Dehner Corporation Uses a Job-Order Costing System with a Single ...

The Budgeted Fixed Manufacturing Overhead Cost Was

The Predetermined Overhead Rate Is Closest To ...