Asked by Kristian Johnston on May 30, 2024

Verified

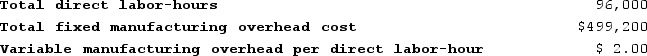

Dehner Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job P951 was completed with the following characteristics:

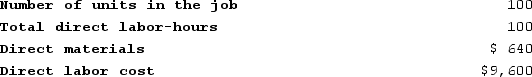

Recently, Job P951 was completed with the following characteristics:

The unit product cost for Job P951 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job P951 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $720.00

B) $109.60

C) $9.60

D) $200.60

Unit Product Cost

The total cost to produce one unit of a product, calculated by dividing the total production costs by the number of units produced.

Direct Labor-hours

The total hours of labor directly involved in manufacturing a product or providing a service, typically used as a basis for allocating overhead costs.

- Learn the method for calculating unit product costs within job-order costing systems.

Verified Answer

Direct materials used = $2,500

Direct labor cost = 45 hours x $15 = $675

Manufacturing overhead cost = $675 x 2.4 = $1,620

Total manufacturing cost = $2,500 + $675 + $1,620 = $4,795

Next, we need to calculate the unit product cost by dividing the total manufacturing cost by the number of units produced.

Unit product cost = $4,795 / 44 = $109.09

Rounding to the nearest cent, the unit product cost for Job P951 is $109.60, which is closest to choice (B).

Learning Objectives

- Learn the method for calculating unit product costs within job-order costing systems.

Related questions

Dehner Corporation Uses a Job-Order Costing System with a Single ...

Dehner Corporation Uses a Job-Order Costing System with a Single ...

Tenneson Corporation's Cost of Goods Manufactured for the Just Completed ...

Shane Corporation Has Provided the Following Data Concerning Last Month's ...

Bocchini Corporation Has Provided the Following Data Concerning Last Month's ...