Asked by Eliani Acosta on May 08, 2024

Verified

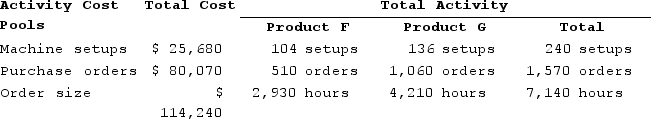

Daston Company manufactures two products, Product F and Product G. The company expects to produce and sell 1,750 units of Product F and 1,950 units of Product G during the current year. Data relating to the company's three activity cost pools are given below for the current year:

Required:Using the activity-based costing approach, determine the overhead cost per unit for each product. (Round your answers to 2 decimal places.)

Required:Using the activity-based costing approach, determine the overhead cost per unit for each product. (Round your answers to 2 decimal places.)

Activity-Based Costing

A pricing technique that allocates expenses to goods or services according to the tasks and materials involved in their creation.

Activity Cost Pools

A costing method that groups all the costs associated with a specific activity, allowing more accurate allocation of costs to products or services.

- Interpret the fundamental concepts of Activity-Based Costing (ABC).

- Compute activity costs per rate for multiple cost pools within an Activity-Based Costing system.

- Apportion indirect financial costs to products using computed activity rates.

Verified Answer

![The activity rates for each activity cost pool are computed as follows: The overhead cost charged to Product F is: The overhead cost charged to Product G is: Overhead cost per unit: Product F: ${{[a(33)]:#,###}} ÷ {{[a(1)]:#,###}} units = ${{[a(44)]:#,###.00}} per unit (rounded)Product G: ${{[a(43)]:#,###}} ÷ {{[a(2)]:#,###}} units = ${{[a(45)]:#,###.00}} per unit (rounded)](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a9_915b_bf83_c3772bed3ebf_TB8314_00.jpg) The overhead cost charged to Product F is:

The overhead cost charged to Product F is:![The activity rates for each activity cost pool are computed as follows: The overhead cost charged to Product F is: The overhead cost charged to Product G is: Overhead cost per unit: Product F: ${{[a(33)]:#,###}} ÷ {{[a(1)]:#,###}} units = ${{[a(44)]:#,###.00}} per unit (rounded)Product G: ${{[a(43)]:#,###}} ÷ {{[a(2)]:#,###}} units = ${{[a(45)]:#,###.00}} per unit (rounded)](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a9_915c_bf83_a9a777fe9d20_TB8314_00.jpg) The overhead cost charged to Product G is:

The overhead cost charged to Product G is:![The activity rates for each activity cost pool are computed as follows: The overhead cost charged to Product F is: The overhead cost charged to Product G is: Overhead cost per unit: Product F: ${{[a(33)]:#,###}} ÷ {{[a(1)]:#,###}} units = ${{[a(44)]:#,###.00}} per unit (rounded)Product G: ${{[a(43)]:#,###}} ÷ {{[a(2)]:#,###}} units = ${{[a(45)]:#,###.00}} per unit (rounded)](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a9_915d_bf83_77de6ad260a1_TB8314_00.jpg) Overhead cost per unit:

Overhead cost per unit:Product F: ${{[a(33)]:#,###}} ÷ {{[a(1)]:#,###}} units = ${{[a(44)]:#,###.00}} per unit (rounded)Product G: ${{[a(43)]:#,###}} ÷ {{[a(2)]:#,###}} units = ${{[a(45)]:#,###.00}} per unit (rounded)

Learning Objectives

- Interpret the fundamental concepts of Activity-Based Costing (ABC).

- Compute activity costs per rate for multiple cost pools within an Activity-Based Costing system.

- Apportion indirect financial costs to products using computed activity rates.

Related questions

Dane Housecleaning Provides Housecleaning Services to Its Clients ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...