Asked by Sheryar Gillani on Apr 29, 2024

Verified

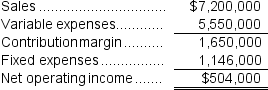

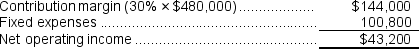

Salvey Inc.reported the following results from last year's operations:  The company's average operating assets were $3,000,000. At the beginning of this year, the company has a $300,000 investment opportunity that involves sales of $480,000, fixed expenses of $100,800, and a contribution margin ratio of 30% of sales.

The company's average operating assets were $3,000,000. At the beginning of this year, the company has a $300,000 investment opportunity that involves sales of $480,000, fixed expenses of $100,800, and a contribution margin ratio of 30% of sales.

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

A) 16.6%

B) 1.3%

C) 18.2%

D) 15.3%

Contribution Margin Ratio

The proportion of sales revenue that is not consumed by variable costs and therefore contributes to covering fixed costs.

Fixed Expenses

Costs that remain constant for a period of time regardless of production levels or business activity.

Combined ROI

The total return on investment generated from a set of investments or projects, combined into a single measure.

- Assess the financial returns of investment for specific business contexts.

- Review the total impact of assorted investment options on the overall efficacy of the company.

Verified Answer

Net operating income = $504,000 + $43,200 = $547,200

Net operating income = $504,000 + $43,200 = $547,200Average operating assets = $3,000,000 + $300,000 = $3,300,000

ROI = Net operating income ÷ Average operating assets = $547,200 ÷ $3,300,000 = 16.6%

Learning Objectives

- Assess the financial returns of investment for specific business contexts.

- Review the total impact of assorted investment options on the overall efficacy of the company.

Related questions

Largo Company Recorded for the Past Year Sales of $750,000 ...

Chavin Company Had the Following Results During August: Net Operating ...

The ROI for the Investment Opportunity Is Closest To

If the Company Pursues the Investment Opportunity and Otherwise Performs ...

Beery Increported the Following Results from Last Year's Operations: ...