Asked by Damario Thompson on May 12, 2024

Verified

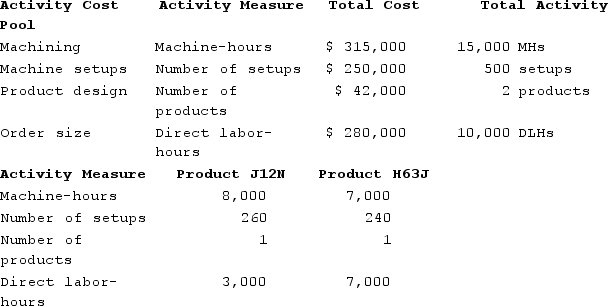

Ciulla Corporation manufactures two products: Product J12N and Product H63J. The company is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products J12N and H63J.

Required:a. Using theactivity-based costing system, how much total manufacturing overhead cost would be assigned to Product H63J?b. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product J12N?

Required:a. Using theactivity-based costing system, how much total manufacturing overhead cost would be assigned to Product H63J?b. Using theactivity-based costing system, what percentage of the total overhead cost is assigned to Product J12N?

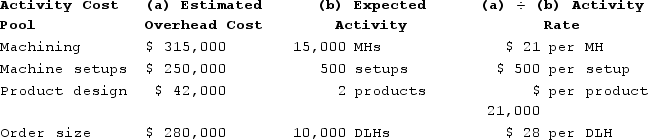

Activity-Based Costing

A costing method that assigns costs to products or services based on the activities and resources that go into creating them, aiming to provide more accurate cost information.

Manufacturing Overhead

All production costs other than direct labor and direct materials.

Product H63J

A specific product, identified by its unique code, which differentiates it from other products within a company's lineup.

- Comprehend deeply the underlying principles of Activity-Based Costing (ABC).

- Distribute overhead expenses among products based on calculated activity rates.

- Define margins for products by means of Activity-Based Costing analysis.

Verified Answer

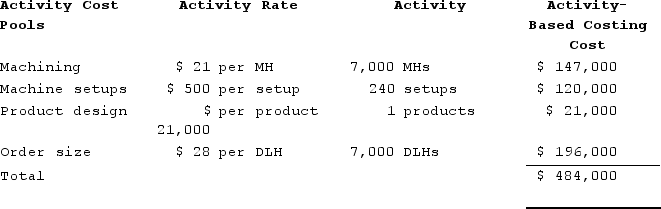

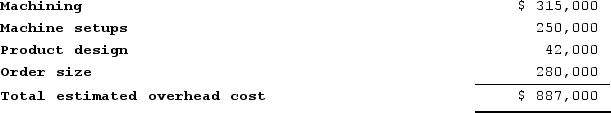

The overhead cost charged to Product H63J under the activity-based costing system is:

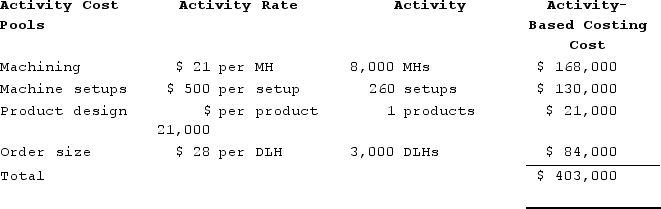

The overhead cost charged to Product H63J under the activity-based costing system is: b. The overhead cost charged to Product J12N under the activity-based costing system is:

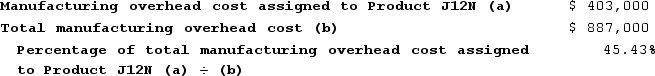

b. The overhead cost charged to Product J12N under the activity-based costing system is:

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product J12N is computed as follows:

Using the activity-based costing system, the percentage of the total overhead cost that is assigned to Product J12N is computed as follows:

Learning Objectives

- Comprehend deeply the underlying principles of Activity-Based Costing (ABC).

- Distribute overhead expenses among products based on calculated activity rates.

- Define margins for products by means of Activity-Based Costing analysis.

Related questions

Dane Housecleaning Provides Housecleaning Services to Its Clients ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...