Asked by Hamish Harries on May 23, 2024

Verified

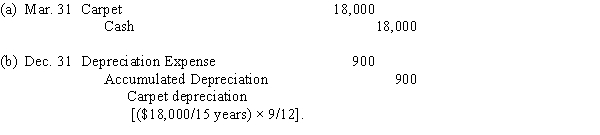

Champion Company purchased and installed carpet in its new general offices on March 31 for a total cost of $18,000. The carpet is estimated to have a 15-year useful life and no residual value.

(a)Prepare the journal entries necessary for recording the purchase of the new carpet.(b)Record the December 31 adjusting entry for the partial-year depreciation expense for the carpet assuming that Champion Company uses the straight-line method.

Straight-Line Method

A depreciation technique where an asset's cost is evenly spread over its estimated useful life, resulting in equal annual depreciation expenses.

Partial-Year Depreciation

The calculation of depreciation for assets acquired or disposed of partway through the fiscal year, based on the portion of the year that the asset was in use.

Useful Life

The estimated period of time over which a tangible asset is expected to be useful for the purposes of the business.

- Understand thoroughly the concepts and methodologies pertaining to depreciation, amortization, and depletion.

- Catalog the activities of acquiring, depreciating, amortizing, and disposing of assets in journal entries.

- Understand and calculate depreciation using different methods including straight-line, double-declining-balance, and units-of-output.

Verified Answer

Learning Objectives

- Understand thoroughly the concepts and methodologies pertaining to depreciation, amortization, and depletion.

- Catalog the activities of acquiring, depreciating, amortizing, and disposing of assets in journal entries.

- Understand and calculate depreciation using different methods including straight-line, double-declining-balance, and units-of-output.

Related questions

On July 1, Hartford Construction Purchases a Bulldozer for $228,000 ...

Machinery Acquired at a Cost of $80,000 and on Which ...

The Depreciation Method That Recognizes Equal Amounts of Annual Depreciation ...

On July 1 of the Current Year,Glover Mining Co ...

A Machine Costing $450,000 with a 4-Year Life and an ...