Asked by Tarja Singh on May 23, 2024

Verified

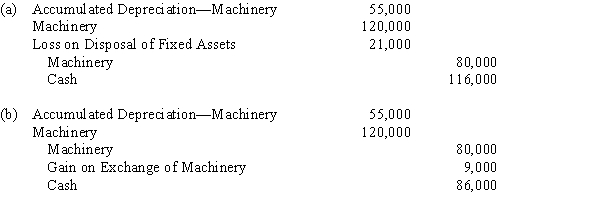

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date) is exchanged for similar machinery. Assume that the transaction has commercial substance. For financial reporting purposes, present entries to record the exchange of the machinery under each of the following assumptions:

(a)Price of new, $120,000; trade-in allowance on old, $4,000; balance paid in cash.(b)Price of new, $120,000; trade-in allowance on old, $34,000; balance paid in cash.

Commercial Substance

A situation in future cash flows of a business that are expected to change significantly due to a transaction, indicating the transaction has economic impact.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a company's assets over time.

Trade-In Allowance

The amount deducted from the price of a new item for trading in something old.

- Record entries related to acquiring, depreciating, amortizing, and disposing of assets in the journal.

- Comprehend the accounting procedures for the exchange of assets that are alike and those that are not.

Verified Answer

TD

Learning Objectives

- Record entries related to acquiring, depreciating, amortizing, and disposing of assets in the journal.

- Comprehend the accounting procedures for the exchange of assets that are alike and those that are not.