Asked by Barbara Circle on Jun 11, 2024

Verified

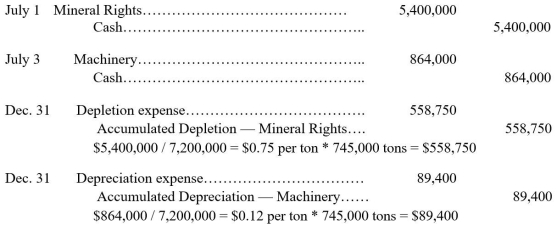

On July 1 of the current year,Glover Mining Co.pays $5,400,000 for land estimated to contain 7,200,000 tons of recoverable ore.It installs machinery on July 3 costing $864,000 that has an 8 year life and no salvage value and is capable of mining the ore deposit in six years.The company removes and sells 745,000 tons of ore during its first six months of operations ending on December 31.Depreciation of the machinery is in proportion to the mine's depletion as the machinery will be abandoned after the ore is mined.Prepare the entries Glover must record for (a)the purchase of the ore deposit,(b)the costs and installation of the machinery,(c)the depletion assuming the land has a zero salvage value,and (d)the depreciation on the machinery.

Recoverable Ore

The portion of ore that can be economically and technically extracted or produced at a profit.

Depletion

The allocation of the cost of natural resources over their useful life, used in accounting to match the expense of extracting natural resources with the revenue generated from them.

Machinery Installation

The process of setting up and configuring industrial machinery in a specific location for operational use.

- Understand the concepts and calculations of depreciation, amortization, and depletion.

- Differentiate between revenue expenditures and capital expenditures.

Verified Answer

Learning Objectives

- Understand the concepts and calculations of depreciation, amortization, and depletion.

- Differentiate between revenue expenditures and capital expenditures.

Related questions

Capital Expenditures That Extend an Asset's Useful Life Beyond Its ...

The Depreciation Method That Recognizes Equal Amounts of Annual Depreciation ...

Revenue Expenditures to Keep an Asset in Good Operating Condition; ...

A Machine Costing $450,000 with a 4-Year Life and an ...

Additional Costs of Plant Assets That Do Not Materially Increase ...