Asked by Aleya Smith on Jul 07, 2024

Verified

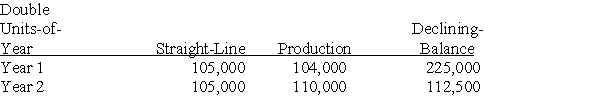

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1.The company estimates the machine will produce 1,050,000 units of product during its life.It actually produces the following units for the first 2 years: Year 1,260,000; Year 2,275,000.Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method.Show calculation of amounts below the table.

Double

Salvage Value

The projected end-of-life resale value of an asset.

Depreciation Method

A systematic approach to allocate the cost of tangible assets over their useful lives, reflecting the asset's consumption, obsolescence, or loss of value.

Productive Units

Measures or quantities of output produced, serving as a basis for allocating costs in some accounting systems.

- Gain insight into the fundamentals and calculation methods pertaining to depreciation, amortization, and depletion.

- Apply the units-of-production and accelerated depreciation methods.

Verified Answer

Straight-line: $450,000- $30,000/4 = $105,000 for each year

Straight-line: $450,000- $30,000/4 = $105,000 for each yearUnits-of-production: $450,000- $30,000/1,050,000 = $.40

Year 1: $.40 * 260,000 = $104,000; Year 2: $.40 * 275,000 = $110,000

Double-declining:

Year 1: $450,000 x .5 = $225,000; Year 2: ($450,000-225,000)x .5 = $112,500

Learning Objectives

- Gain insight into the fundamentals and calculation methods pertaining to depreciation, amortization, and depletion.

- Apply the units-of-production and accelerated depreciation methods.

Related questions

The Depreciation Method That Recognizes Equal Amounts of Annual Depreciation ...

On July 1 of the Current Year,Glover Mining Co ...

The Depreciation Method That Charges a Varying Amount to Expense ...

On July 1, Hartford Construction Purchases a Bulldozer for $228,000 ...

Champion Company Purchased and Installed Carpet in Its New General ...