Asked by Ja'Lisa Hicks on May 06, 2024

Verified

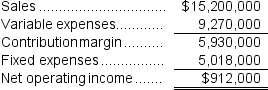

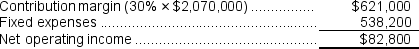

Wiswell Inc.reported the following results from last year's operations:  The average operating assets were $8,000,000. At the beginning of this year, the company has a $900,000 investment opportunity that would involve sales of $2,070,000, a contribution margin ratio of 30% of sales, and fixed expenses of $538,200.The company's minimum required rate of return is 10%.If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

The average operating assets were $8,000,000. At the beginning of this year, the company has a $900,000 investment opportunity that would involve sales of $2,070,000, a contribution margin ratio of 30% of sales, and fixed expenses of $538,200.The company's minimum required rate of return is 10%.If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

A) $104,800

B) $925,600

C) ($19,800)

D) $994,800

Combined Residual Income

This term might refer to the total residual income from various sources or projects, but without a standard definition, its specific meaning can vary.

Required Rate Of Return

The minimum percentage return that an investor expects to receive from an investment.

Contribution Margin Ratio

Contribution Margin Ratio is a company's contribution margin expressed as a percentage of its total sales, indicating the portion of sales revenue that is not consumed by variable costs.

- Compute and elucidate the concept of residual income utilizing specific financial information.

- Assess the cumulative impact of various investment options on the company's overall performance.

Verified Answer

TF

Tiffany FerreiraMay 08, 2024

Final Answer :

A

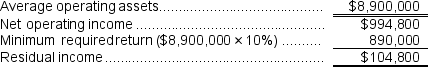

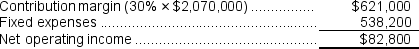

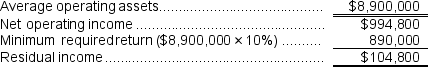

Explanation :  Net operating income = $912,000 + $82,800 = $994,800

Net operating income = $912,000 + $82,800 = $994,800

Average operating assets = $8,000,000 + $900,000 = $8,900,000

Net operating income = $912,000 + $82,800 = $994,800

Net operating income = $912,000 + $82,800 = $994,800Average operating assets = $8,000,000 + $900,000 = $8,900,000

Learning Objectives

- Compute and elucidate the concept of residual income utilizing specific financial information.

- Assess the cumulative impact of various investment options on the company's overall performance.