Asked by Chasity Fields on Jun 17, 2024

Verified

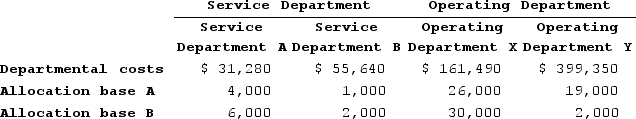

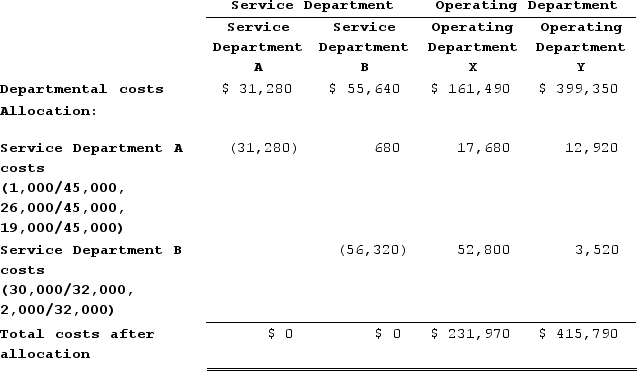

Vitro Corporation has two service departments, Service Department A and Service Department B, and two operating departments, Operating Department X and Operating Department Y.

The company uses the step-down method to allocate service department costs to operating departments. Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.Required:Allocate the service department costs to the operating departments using the step-down method.

The company uses the step-down method to allocate service department costs to operating departments. Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.Required:Allocate the service department costs to the operating departments using the step-down method.

Step-Down Method

An allocation technique used in cost accounting to distribute overhead costs among various cost centers or departments with multiple service departments.

Operating Department Y

A specific division within an organization that is focused on core operational tasks related to producing goods or services.

- Gain an understanding of the methods used for service department cost distribution.

- Gain insights into the application of the step-down technique for the apportionment of service department costs.

- Analyze the impact of different allocation bases on the distribution of service department costs.

Verified Answer

Allocation base for Service Department B costs = 30,000 + 2,000 = 32,000

Learning Objectives

- Gain an understanding of the methods used for service department cost distribution.

- Gain insights into the application of the step-down technique for the apportionment of service department costs.

- Analyze the impact of different allocation bases on the distribution of service department costs.

Related questions

Alpha Manufacturing Corporation Has Two Service Departments, Custodial Services and ...

Muckenfuss Clinic Uses the Step-Down Method to Allocate Service Department ...

Dainels Corporation Uses the Step-Down Method to Allocate Service Department ...

In Both the Direct and Step-Down Methods of Allocating Service ...

The Step-Down Method of Service Department Cost Allocation Ignores Interdepartmental ...