Asked by Jeremy Dyzenhaus on Jun 18, 2024

Verified

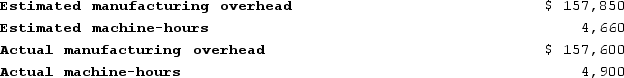

Acheson Corporation, which applies manufacturing overhead on the basis of machine-hours, has provided the following data for its most recent year of operations.  The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year.The applied manufacturing overhead for the year is closest to: (Round your intermediate calculations to 2 decimal places.)

The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year.The applied manufacturing overhead for the year is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $213,248

B) $157,584

C) $165,718

D) $165,963

Manufacturing Overhead

Manufacturing overhead encompasses all the indirect costs associated with producing goods, except for direct labor and direct materials.

- Learn the fundamentals of manufacturing overhead and its implementation according to various bases such as direct labor-hours and machine-hours.

- Work out predetermined rates for overhead and grasp their employment in assigning manufacturing overhead expenditures to products or job orders.

Verified Answer

IG

Iemina GreceaJun 19, 2024

Final Answer :

D

Explanation :

To calculate the applied manufacturing overhead, we first need to determine the predetermined overhead rate. The formula for that is:

Predetermined Overhead Rate = Estimated Manufacturing Overhead / Estimated Machine-Hours

Predetermined Overhead Rate = $211,200 / 32,000 machine-hours = $6.60 per machine-hour

To calculate the applied manufacturing overhead, we use the actual machine-hours worked during the year:

Applied Overhead = Actual Machine-Hours x Predetermined Overhead Rate

Applied Overhead = 25,164 machine-hours x $6.60 per machine-hour = $165,963

Therefore, the closest answer is D) $165,963.

Predetermined Overhead Rate = Estimated Manufacturing Overhead / Estimated Machine-Hours

Predetermined Overhead Rate = $211,200 / 32,000 machine-hours = $6.60 per machine-hour

To calculate the applied manufacturing overhead, we use the actual machine-hours worked during the year:

Applied Overhead = Actual Machine-Hours x Predetermined Overhead Rate

Applied Overhead = 25,164 machine-hours x $6.60 per machine-hour = $165,963

Therefore, the closest answer is D) $165,963.

Learning Objectives

- Learn the fundamentals of manufacturing overhead and its implementation according to various bases such as direct labor-hours and machine-hours.

- Work out predetermined rates for overhead and grasp their employment in assigning manufacturing overhead expenditures to products or job orders.

Related questions

Baka Corporation Applies Manufacturing Overhead on the Basis of Direct ...

Compton Company Uses a Predetermined Overhead Rate in Applying Overhead ...

Martin Company Applies Manufacturing Overhead Based on Direct Labor Hours ...

Fort Corporation Had the Following Transactions During Its First Month ...

Baab Corporation Is a Manufacturing Firm That Uses Job-Order Costing ...