Asked by Lizbeth RamosPerdomo on May 11, 2024

Verified

Fort Corporation had the following transactions during its first month of operations:

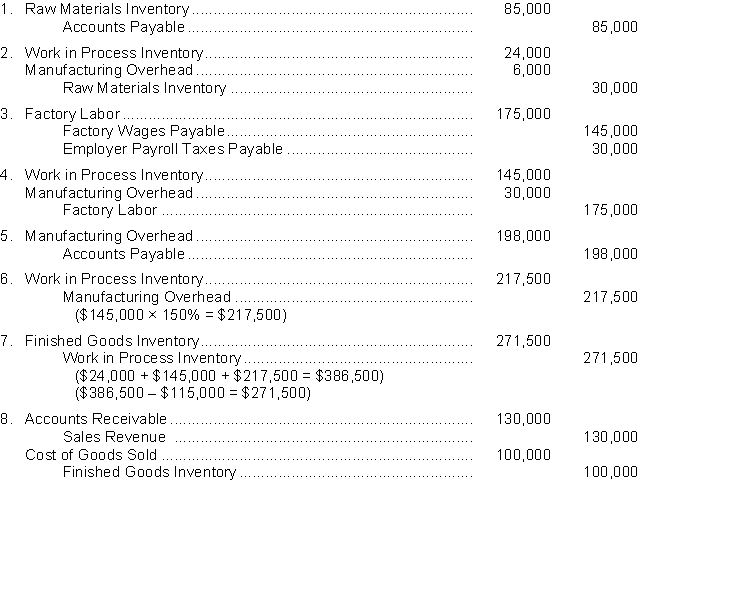

1. Purchased raw materials on account $85000.

2. Raw Materials of $30000 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $6000 was classified as indirect materials.

3. Factory labor costs incurred were $175000 of which $145000 pertained to factory wages payable and $30000 pertained to employer payroll taxes payable.

4. Time tickets indicated that $145000 was direct labor and $30000 was indirect labor.

5. Overhead costs incurred on account were $198000.

6. Manufacturing overhead was applied at the rate of 150% of direct labor cost.

7. Goods costing $115000 are still incomplete at the end of the month; the other goods were completed and transferred to finished goods.

8. Finished goods costing $100000 to manufacture were sold on account for $130000.

Instructions

Journalize the above transactions for Fort Corporation.

Indirect Materials

Materials used in the production process that cannot be directly traced to a finished product.

Employer Payroll Taxes

Taxes that employers are required to pay on behalf of their employees, including Social Security and Medicare taxes in the United States.

Manufacturing Overhead Applied

The portion of manufacturing overhead costs allocated to each unit of production.

- Comprehend the documentation of raw materials, work in progress, finished products, and manufacturing overhead costs in a job order costing system.

- Determine predetermined overhead rates and allocate overhead to manufacturing expenses.

- Compile ledger entries related to transactions encompassing raw materials, labor, overhead costs, and sales activities.

Verified Answer

Learning Objectives

- Comprehend the documentation of raw materials, work in progress, finished products, and manufacturing overhead costs in a job order costing system.

- Determine predetermined overhead rates and allocate overhead to manufacturing expenses.

- Compile ledger entries related to transactions encompassing raw materials, labor, overhead costs, and sales activities.

Related questions

Selected Accounts of Kosar Manufacturing Company at Year End Appear ...

The Manufacturing Operations of Beatly Inc Beatly Transferred $270000 of ...

The Following Inventory Information Is Available for Ricci Manufacturing Corporation ...

Sardin Company Begins the Month of March with $17000 of ...

Grant Marwick and Associates a CPA Firm Uses Job Order ...