Asked by Alyssa Noriega on May 11, 2024

Verified

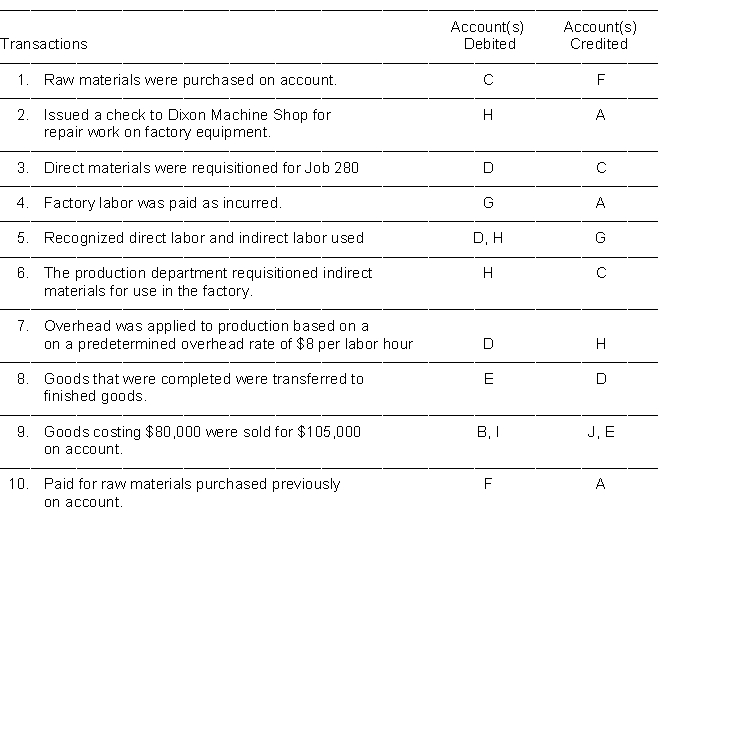

A selected list of accounts used by Cline Manufacturing Company follows: Code Code A Cash F Accounts Payable B Accounts Receivable G Factory Labor C RawMaterials Inventory H Manufacturing Overhead D Work In Process Inventory I Cost of Goods Sold E Finished Goods Inventory J Sales Revenue \begin{array} { l c l } \text { Code } & \text { Code } \\\text { A Cash } & \text { F } & \text { Accounts Payable } \\\text { B Accounts Receivable } & \text { G } & \text { Factory Labor } \\\text { C RawMaterials Inventory } & \text { H } & \text { Manufacturing Overhead } \\\text { D Work In Process Inventory } & \text { I } & \text {Cost of Goods Sold } \\\text { E Finished Goods Inventory } & \text { J } & \text {Sales Revenue }\end{array} Code A Cash B Accounts Receivable C RawMaterials Inventory D Work In Process Inventory E Finished Goods Inventory Code F G H I J Accounts Payable Factory Labor Manufacturing Overhead Cost of Goods Sold Sales Revenue Cline Manufacturing Company uses a job order system and maintains perpetual inventory records.

Instructions

Place the appropriate code letter in the columns indicating the appropriate account(s) to be debited and credited for the transactions listed below.

Job Order System

An accounting system that tracks costs individually for each job, suitable for manufacturing processes that differ significantly from job to job.

Manufacturing Overhead

Indirect factory-related costs incurred in the production process, such as depreciation of equipment and utility costs.

Factory Labor

It refers to the workforce engaged in manufacturing processes, often within a factory setting, and encompasses all labor costs directly associated with the creation of a company's products.

- Prepare journal entries for transactions involving raw materials, labor, overhead, and the sales process.

Verified Answer

Learning Objectives

- Prepare journal entries for transactions involving raw materials, labor, overhead, and the sales process.

Related questions

Grant Marwick and Associates a CPA Firm Uses Job Order ...

Selected Accounts of Kosar Manufacturing Company at Year End Appear ...

Fort Corporation Had the Following Transactions During Its First Month ...

The Following Inventory Information Is Available for Ricci Manufacturing Corporation ...

The Journal Entry to Record the Application of Manufacturing Overhead ...