Asked by Sameeha Riptee on Jun 23, 2024

Verified

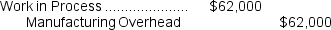

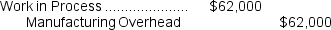

The journal entry to record the application of Manufacturing Overhead to Work in Process would include a:

A) credit to Manufacturing Overhead of $62,000

B) debit to Work in Process of $60,000

C) credit to Work in Process of $60,000

D) debit to Manufacturing Overhead of $62,000

Work in Process

Goods that are midway through the manufacturing process but are not fully finished.

Manufacturing Overhead

All indirect costs associated with the production process, from maintenance expenses of the production facility to the supplies needed for operation.

Journal Entry

A record in accounting that represents a transaction, consisting of debits and credits, in the financial books.

- Gain an understanding of manufacturing overhead, including how it is apportioned to products.

- Conduct the process of logging financial entries for manufacturing sequences, from buying raw materials to the allocation of final products.

Verified Answer

KS

Kaizer SayaniJun 26, 2024

Final Answer :

A

Explanation :  Reference: CH03-Ref4

Reference: CH03-Ref4

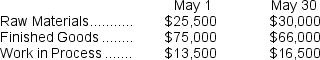

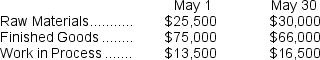

Tyare Corporation had the following inventory balances at the beginning and end of May: During May, $58,500 in raw materials (all direct materials)were drawn from inventory and used in production.The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour.A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account.The ending Work in Process inventory account contained $7,050 of direct materials cost.The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.

During May, $58,500 in raw materials (all direct materials)were drawn from inventory and used in production.The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour.A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account.The ending Work in Process inventory account contained $7,050 of direct materials cost.The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.

Reference: CH03-Ref4

Reference: CH03-Ref4Tyare Corporation had the following inventory balances at the beginning and end of May:

During May, $58,500 in raw materials (all direct materials)were drawn from inventory and used in production.The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour.A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account.The ending Work in Process inventory account contained $7,050 of direct materials cost.The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.

During May, $58,500 in raw materials (all direct materials)were drawn from inventory and used in production.The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour.A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account.The ending Work in Process inventory account contained $7,050 of direct materials cost.The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.

Learning Objectives

- Gain an understanding of manufacturing overhead, including how it is apportioned to products.

- Conduct the process of logging financial entries for manufacturing sequences, from buying raw materials to the allocation of final products.