Asked by Savannah Pulliam on May 05, 2024

Verified

The following inventory information is available for Ricci Manufacturing Corporation for the year ended December 31 2017: Beginning Ending Inventories: Raw materials $17,000$19,000 Work in process 9,00014,000 Finished goods 11,0008,000 Total $37,000‾$41,000‾\begin{array} { c r r } & \text { Beginning } & \text { Ending } \\\text { Inventories: } & & \\\text { Raw materials } & \$ 17,000 & \$ 19,000 \\\text { Work in process } & 9,000 & 14,000 \\\text { Finished goods } & 11,000 & 8,000 \\\text { Total } & \underline { \$ 37,000 } & \underline { \$ 41,000 }\end{array} Inventories: Raw materials Work in process Finished goods Total Beginning $17,0009,00011,000$37,000 Ending $19,00014,0008,000$41,000 In addition the following transactions occurred in 2017:

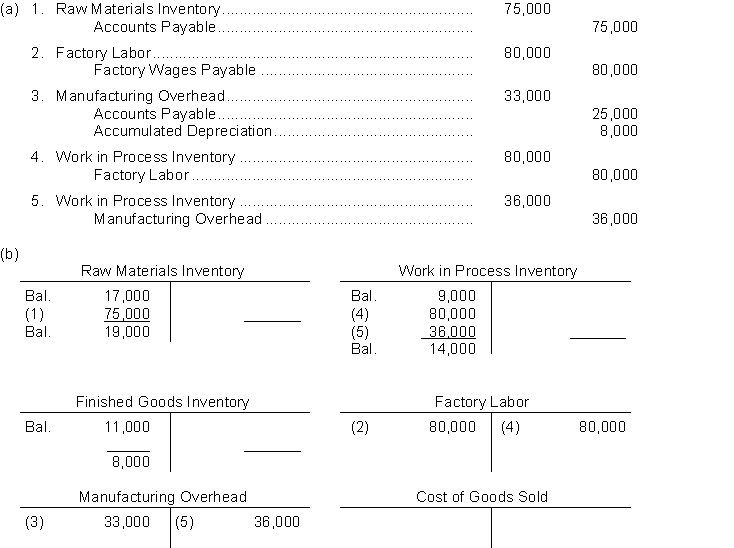

1. Raw materials purchased on account $75000.

2. Incurred factory labor $80000 all is direct labor. (Credit Factory Wages Payable).

3. Incurred the following overhead costs during the year: Utilities $6800 Depreciation on manufacturing machinery $8000 Manufacturing machinery repairs $9200 Factory insurance $9000 (Credit Accounts Payable and Accumulated Depreciation).

4. Assigned $80000 of factory labor to jobs.

5. Applied $36000 of overhead to jobs.

Instructions

(a) Journalize the above transactions.

(b) Reproduce the manufacturing cost and inventory accounts. Use T-accounts.

(c) From an analysis of the accounts compute the following:

1. Raw materials used.

2. Completed jobs transferred to finished goods.

3. Cost of goods sold.

4. Under- or overapplied overhead.

Inventory Information

Details about the quantities, locations, and values of a company's inventory, used for managing and reporting purposes.

Manufacturing Cost

The total cost incurred by a company to produce a specific quantity of a product, including direct labor, raw materials, and overhead.

Raw Materials Used

The total cost of all components and materials directly used to manufacture a product within a specific period.

- Acquire knowledge on the recording process of raw materials, work in process, finished goods, and manufacturing overhead within a job order costing framework.

- Draft bookkeeping records for transactions pertinent to raw materials, labor charges, overhead expenses, and sales procedures.

- Ascertain the cost of goods sold, with corrections for overapplied or underapplied overhead included.

Verified Answer

(c) 1. Raw materials used = $17000 + $75000 - $19000 = $73000.

(c) 1. Raw materials used = $17000 + $75000 - $19000 = $73000.2. Completed jobs transferred to finished goods = W/P debits

$9000 + $73000 + $116000 - $14000 = $184000.

3. Cost of goods sold = $11000 + $184000 - $8000 = $187000.

4. Overhead overapplied = $3000 (credit balance in Manufacturing Overhead).

Learning Objectives

- Acquire knowledge on the recording process of raw materials, work in process, finished goods, and manufacturing overhead within a job order costing framework.

- Draft bookkeeping records for transactions pertinent to raw materials, labor charges, overhead expenses, and sales procedures.

- Ascertain the cost of goods sold, with corrections for overapplied or underapplied overhead included.

Related questions

Fort Corporation Had the Following Transactions During Its First Month ...

The Manufacturing Operations of Beatly Inc Beatly Transferred $270000 of ...

Grant Marwick and Associates a CPA Firm Uses Job Order ...

A Selected List of Accounts Used by Cline Manufacturing Company ...

Selected Accounts of Kosar Manufacturing Company at Year End Appear ...