Asked by Thembani VUTUZA on Jul 05, 2024

Verified

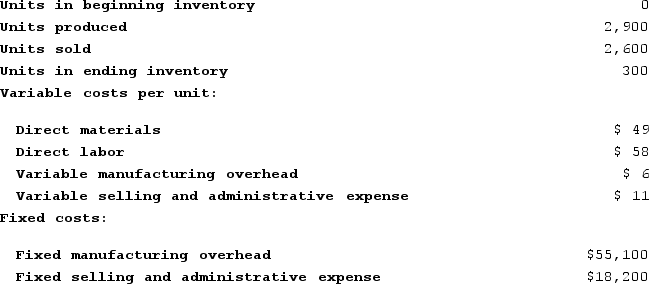

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the absorption costing unit product cost for the month?

What is the absorption costing unit product cost for the month?

A) $124 per unit

B) $132 per unit

C) $113 per unit

D) $143 per unit

Unit Product Cost

The total cost to produce one unit of a product, including direct labor, direct materials, and allocated overhead expenses.

Operations

Refers to the day-to-day activities involved in the running of a business that are essential for producing and delivering goods or services.

- Digest the nuances between absorption costing and variable costing and their consequences on net operating income.

- Compute the production cost per unit when applying absorption costing techniques.

Verified Answer

DM

David MilbourneJul 12, 2024

Final Answer :

B

Explanation :

Absorption costing includes both variable and fixed manufacturing costs in the unit product cost. Using the formula:

Unit Product Cost = (Total Manufacturing Costs + Selling and Administrative Costs) / Total Units Produced

Unit Product Cost = (($836,000 + $108,000) / 7,000)

Unit Product Cost = $121.14 per unit

Therefore, the absorption costing unit product cost for the month is $132 per unit (rounded to the nearest cent).

Unit Product Cost = (Total Manufacturing Costs + Selling and Administrative Costs) / Total Units Produced

Unit Product Cost = (($836,000 + $108,000) / 7,000)

Unit Product Cost = $121.14 per unit

Therefore, the absorption costing unit product cost for the month is $132 per unit (rounded to the nearest cent).

Learning Objectives

- Digest the nuances between absorption costing and variable costing and their consequences on net operating income.

- Compute the production cost per unit when applying absorption costing techniques.